Posted on 01/13/2016 9:27:00 AM PST by NRx

You have a better chance of getting hit by lightning in a frog thunderstorm than you do winning the Powerball, but hey, it's always fun to play billionaire. If you were to win (and you won't), there are a few things you should to do to protect and optimize your winnings.

http://lifehacker.com/winning-the-po...

Ah, the age old question all lottery winners (well, big winners) have to contend with: Do you take the annuity or the lump sum amount?

With the annuity, you get your payout over time, and you'll get more money. If you win this Powerball Jackpot, you can opt for 30 annual payments that average to about $37 million, after Federal taxes. That adds up to just over a billion dollars over time. (This varies depending on what state you live in, because you have to consider those pesky state taxes).

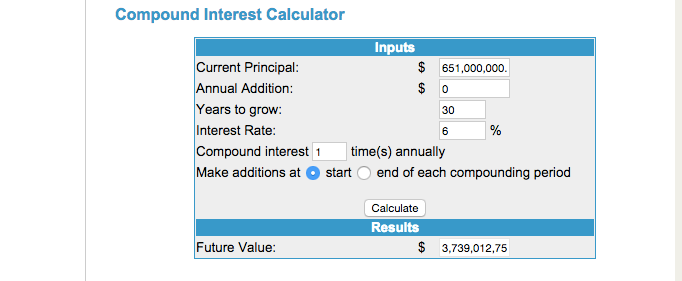

With the lump sum, you get all your money at once, but after Federal taxes, that's about $651 million. Pretty good, I guess, but it's no billion dollars. Here's the thing, though: even though the annuity adds up more over time, lump sum could still be a more lucrative option if you invest it, thanks to a little thing called compound interest. Let's say you invest that $651 million into the broad stock market, which earns about 6-7% each year, on average, after inflation. To keep things simple, we'll assume you don't have state taxes. In five years, you'd earn $871 million. In 30 years--the payout term for the annuity--you'd earn $3.74 billion. That more than makes up for the money you lost by opting for the lump sum amount.

It's not quite that simple, though. For one, you have to pay taxes on the money you earn from investing, and there's a big tax advantage to the annuity option. Tax Lawyer David Hryck explains:

If you take the lump sum, you will be paying taxes twice. You pay on the prize itself and again on your investments. If you go the annuity route you will pay taxes on each installment but you will not pay taxes on your investments of the money while the government essentially holds your winnings for you. Over time, this will add up for you as your winnings grow with no tax stipulations.

With the annuity option, Powerball basically invests the money on your behalf, and, according to Hryck, you earn a pre-tax rate of about 2.8%. That's not much, and you can do better investing on your own, but remember: that money is growing tax-free. As The New York Times points out, "you'll never beat the effective tax rate of zero on the investment income earned inside the Powerball annuity."

http://www.nytimes.com/2016/01/13/ups...

Of course, you can invest your annual annuity payout in the broad market, too, and then you pay taxes on those earnings as well. Like we said, it's complicated.

These scenarios also assume you'll invest your entire winnings, which is unrealistic (that private island isn't gonna pay for itself). They assume you have decades to invest and wait out market slumps. There are so many numbers to crunch and the outcome really depends on how long you have to invest, what kind of yield you can expect, and where you live.

A multimillionaire shouldn't have to do this much math.

Thankfully, Business Insider crunched some numbers with a lottery a few years ago, and here's what they concluded:

if you can score a rate of return somewhere between 3% and 4%, you're still better off with the lump sum...Factoring in investment, though, it only makes sense to take the lump sum if you think you can get an altogether reasonable rate of return.

Even the most basic, set and forget investment portfolio averages 6-7% on average, so those numbers point to lump sum. But it basically comes down to the advantage of investing the lump sum vs. the tax savings of the annuity. And most experts seem to think the tax savings of the annuity outweigh the return of the lump sum. You might also choose the annuity if you have a hard time managing your money.

Before rushing out to claim your ticket, take a moment to soak it all in. You're a multimillionaire, I know! It's time for couch jumping and champagne popping. However, if there's one thing I've learned from sitcoms, it's that acting impulsively when you win the lottery always backfires.

You need time to understand the rules and come up with a reasonable plan. And don't worry about missing the deadline: in most states, you have 180 days to claim your ticket. (Mark your calendar, though, because you'll be kicking yourself if you miss that deadline!)

Make a copy of your ticket and put the original in a safe place (like literally, a safe.) When friends, family, and creditors find out you won, they'll start hitting you up nonstop. Forbes recommends the following strategy to avoid this:

...check state rules to see whether you can dodge them all by remaining anonymous...rules on winner publicity vary by state. In New York, for example, winners' names are a public record. Elsewhere it may be possible to maintain your anonymity by setting up a trust or limited liability company to receive the winnings, says Beth C. Gamel, a CPA with Pillar Financial Advisors in Waltham, MA. A client of Gamel's who won a past lottery did that, and had a lawyer claim the prize on behalf of of the trust. In South Carolina, where the Sept. 18 winner bought his or her ticket, it's also possible to remain anonymous.

If you're married, your spouse is entitled to some of the winnings. According to Legal Zoom, spouses' earnings are generally considered marital income, so if you buy something with those earnings--even if it's a lottery ticket--that item becomes marital property. If you're going through a divorce and you won the lottery, your ex might be entitled to some of the winnings, too. It depends on how far along you are in the divorce and where you live (laws vary by state).

Maybe you won the Powerball as part of an office pool. In thie case, things get a little messy. You should've thought about that before asking Noel in accounting to go in with you, but here you are. In most states, there can only be one payee per ticket. So you'll have to create a single entity to represent all of the winners. AmericanBar.org explains how this works:

Thus, in a multiple- beneficiary situation, it is advisable to create an entity because if only one person in the pool claims the prize, when that person distributes shares of the prize to the other members of the group, it could be a taxable gift. In addition, only that individual will receive the W-2G, reporting the lottery winnings as 100 percent taxable to him or her for income tax purposes. Further, the other members of the pool may not be comfortable with just one member claiming the prize as the winner, individually... In these instances a group arrangement should be used for all purposes and should be documented appropriately.

A good lawyer will walk you through these issues, but it helps to know what to expect. Once you do claim your ticket, you'll have another 60 days to decide how you'll receive payment.

http://lifehacker.com/5826959/how-to...

Congratulations--you're in the one percent! This means you'll pay a ton of taxes, but unlike your peers, you won't get a chance to think about how to shelter your millions with tax loopholes. You've gotta pay up.

The Powerball website crunched the numbers for you so you can see what you'll pay in both Federal and state taxes, depending on where you live, and depending on whether you take the lump sum or annuity.

Assuming you quit your job, you'll have to pay estimated quarterly taxes now, too. A good CPA will help you figure this out so you can avoid tax penalties. It's pretty easy, though. When you don't have a full-time job, you don't have an employer to make regular tax payments during the year on your behalf. So you have to make these payments yourself every few months, using IRS Form 1040 ES, if you have any income during the year. You can pay these taxes online, too.

http://lifehacker.com/268406/pay-you...

Keep in mind: you're also in the highest possible tax bracket now, too. For 2016, that means your federal income tax rate is 39.6%. Again, you'll pay all of your taxes at once with the lump sum, so that rate won't change. However, if you opt for the annuity, your rate could very well change over the years. Here's how one tax pro explained it to Business Insider:

"As we know tax rates are always changing. If you take a lump sum you are looking at a 39.6% rate. If you take an annuity over the next 30 years the rates will probably be very different when you receive each payment." So people who expect that the top tax rate will decrease over time -- or that the Flat Tax crowd will win -- should take that annuity.

On the other hand, if you think the tax rate will only get higher over time, you'll want to take the lump sum.

At the very least, you're going to need an attorney, a Certified Financial Planner, and a tax preparer.

An estate attorney will help you figure out how to set up a Will and Trust as well as other complicated legal documents. Here's what estate lawyer Barry Nelson says you'll need:

In preparing a Will and Trust, the lottery ticket winner will have to consider difficult non-tax issues. For example, at what age should the winner's children inherit such large sums of money in the event of the lottery winner's death. Most of my clients believe that it is advantageous to delay large distributions to younger family members until they finish college and have work experience so they obtain a healthy work ethic.

Find a good lawyer by asking a trusted friend or family member or running a search on the American Bar Association website. You might even reach out to past lottery winners, suggests Richard Morrison, who won $165 million back in 2009.

http://business.time.com/2012/11/29/pow...

undefined business.​time.​com

When you meet with your lawyer or interview them over the phone, you should feel comfortable, and they should explain things clearly. And watch out for this big red flag, as lawyer John M. Phillips points out on his website:

Do NOT agree to allow them a percentage of your winnings or anything crazy like that. If they ask... that's the wrong lawyer. Just find someone who you trust and come up with fair retainer and/or hourly compensation to help you make good decisions and protect you from people who will look to separate you from your windfall.

When you look for a financial planner, make sure it's a Certified Financial Planner, who takes a fiduciary oath and is legally required to act in your best interest. Ideally, you want a fee-only financial advisor, too. This CFP should also be able to help you with taxes or refer you to someone who can help.

http://twocents.lifehacker.com/how-to-find-an...

A good lawyer will help protect your money. They'll suggest a series of legal moves and insurance products to help protect you against all the things that might possibly go wrong with your money: lawsuits, creditors, divorce.

Forbes explains how this asset protection plan works in a little more detail.

The best defense is to erect a variety of roadblocks that make it difficult, if not impossible, for creditors to reach your money and property. These asset protection strategies, as they are called, can range from relying on state-law exemptions to creating multiple barriers through the use of trusts and family limited partnerships or limited liability companies. It may be possible to rely on a variety of strategies, either separately or in combination with each other.

For example, Morrison told Time that his lawyers even suggested kidnap and ransom insurance to protect his family. He says he opted out but hired security to protect his home and children. He also suggested claiming your ticket at a lottery office far from your home town.

Of course, it's probably a good idea to pay off old debt and learn a few good financial habits, too. You're rich, I get it, but if it can happen to Wayne Newton, it can happen to you. Plus, when you have debt to pay, that means you're paying interest. Obviously, you want to pay all of that off at once so your debt interest doesn't offset the interest you earn from investing.

In general, though, you'll probably be fine. With some proper planning and a basic understanding of how the system works, you should be in pretty good shape. That is, assuming you actually win.

Land. I would buy properties in several places around the world.

A cozy mountain home in the Swiss Alps.

Another home on the Amafi coast in Italy, probably the Sorrento area.

Large wooded ranch out West -Maybe Utah, New Mexico...

A several thousand acre hunter’s paradise in the Southeast.

A nice Condo in Trump Tower in Manhattan.

A Florida condo in Miami Beach.

A Hawaii beach house.

Maybe an island off the Maine or Nova Scotia coast.

The last time I played lottery, powerball was $1.00 a ticket. When it gets past .5 Billion, I’ll throw a couple of bucks into the kitty. What the hell. More than a Billion and I’ll throw a few more bucks in. But I ain’t gonna go crazy about it. What ever I’ve spent on the lottery in my lifetime is well under a hundred.

“You never really own your property. Tribute must always be paid to a bunch of retards sitting at a table who threaten you with violence perpetrated by simpletons in silly uniforms”

Excellent! Quote of the day!

I’d bail out the F-35 program. Wait. that is n’t enough money.

Before cashing in a big ticket, go to court and change your name to something really common, i.e “Richard Anderson” or “Mary Miller”. Get a new ID & SS card under that name and use these to claim your prize. Afterward, change back to your original name or to something else. That one should probably be done out of state. Leave the media hounds, salesmen, scammers and leeches looking for someone who doesn’t exist.

“I don’t mind paying the “voluntary tax on the stupid†when I get a few lottery tickets. It’s worth a few bucks to rev up the imagination about all the “what if†ideas.”

Bingo! I only play 2 or 3 times a year when the jackpots are big enough to draw attention. I figure it’s worth the cash to have fun dreaming for a bit.

I will now be able to proudly say “Super Size it!”

Can now go to Walmart instead of the Dollar store.

I’ll have bacon on the burger AND fries.

Tax question - if you take the lump sum, you have to pay state tax for the state in which you bought the ticket.

But suppose you take the annuity - First year, yes you have to pay state tax based on the state where the ticket was purchased. That leaves a follow on question for the annuity payments. Suppose you move to a state that does not tax the annuity (Florida). Do you still have to pay the original state taxes each year? I would not think so.

I only buy tickets when the jackpots swell and are on the news. Somebody will win and it might as well be me. I also just buy one or two tickets....it’s not an investment....I have heard all the arguments against buying the tickets, but I just want to believe it could be me. When it is not, I never fret over it.

I would use the money to enjoy life away from crowds and to find a way to help some deserving folks and causes quietly and without fanfare.

BINGO

I always said I would buy the biggest ranch land I could afford and put as many rescue horses on it that it could reasonably sustain. I love watching horse run they way they were meant too.

Then there is the dog and cat facilities

But my first priority would be children suffering around the world. Give to those orphanages and try to adopt as many as I could

We are doing it here at work, 40 of us....I would contact my cousin who is a certified financial planner, pay my debts and mortgage, give my condo to someone in the Military, resign, but an Escalade, move to New Hampshire (have a ton of homes picked out) and enjoy with the family and a few close friends.....also I would contribute to the Military and Vets and a few animal shelters.

Bump

“The annuity is a certified asset. If you die it would become part of your estate and pass to your heirs.”

And the present value of the annuity is considered as taxable income. States will make annual annuity payments to you and then to your heirs until the money runs out. If you die before receiving all your annuity payments, your estate and heirs could face a whopping death-tax bill on all the unpaid money remaining in the annuity. That tax would be due all at once in the year of your death. In effect, your estate and heirs would owe tax today on money that won’t be paid for years to come.

Shut down the all Kardashian TV shows.

P.O. my wife and get my Driving Permit, State Authorized Legally reissued, get Auto insurance for me, and buy a new truck, with the Raging Hot New Cooper Tires with a full Spare Tire: and to make continuing to live possible; buy her wife a new car of her choice.

Right off the bat I’d go out and purchase the new Ford GT.......with snow tires.

Sidenote: I notice we’re only up to $1.5 billion from $1.3 billion on Saturday. That’s $200 million in four days. Compare that to an increase of $600+ million in three days for the previous draw. Fewer ticket sales means sparser coverage of the combinations, and thus we might very well see another rollover or two. Can anyone say “two billion dollars?”

Not an option here. But fortunately my name is common enough that there are about twenty-thirty of me in my county, so I can say "nope, it ain't me" as I quietly fade from sight.

The last drawing had about 75% of the possible numbers chosen. Lottery officials have said they expect slightly over 85% for tonight’s drawing. So yeah it’s possible, but unlikely.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.