Keep looking over your shoulder GGG. Tell us

again how you're so much smarter than the markets.

Now you can explain to us why that trade

deficit you whine about is killing us. LOL!!

Posted on 10/26/2006 12:53:25 PM PDT by GodGunsGuts

The price of existing homes last month fell 2.2 percent, the largest monthly decline in the almost four decades the number has been tracked, according to an industry report released yesterday.

Nationwide, the number of existing single-family homes sold fell 14.2 percent in September compared with September 2005, according to the report from the National Association of Realtors. The number of sales has fallen each month since March.

Prices fell everywhere in the country, with the Northeast and West most affected. Declines were more moderate in the South, which includes the Washington area....

(Excerpt) Read more at washingtonpost.com ...

I have never purchased anything at a pawn shop with silver.

I have in fact bought things with gold.

And they did give me a premium.

Thanks for clearing that up. A pawn shop gave you more than your gold was worth. Cool.

Keep looking over your shoulder GGG. Tell us

again how you're so much smarter than the markets.

Now you can explain to us why that trade

deficit you whine about is killing us. LOL!!

No. The article's numbers are based on median value not average value, so your example isn't relevant. To get the published median value to work in your example, townhome prices would indeed have to fall a bit. The shocking statistic that I'd observe in your example is that sales of houses greater than a million dollars fell by 50% in one month.

WASHINGTON (MarketWatch) -- The net worth of U.S. households increased 0.1% in the second quarter to $53.3 trillion, the slowest gain in nearly four years, the Federal Reserve said Tuesday in its quarterly flow of funds report.

After adjusting for inflation and population growth, net worth fell in the quarter. Per-capita net worth fell to $178,290 from $178,505 in the first quarter.

http://www.marketwatch.com/News/Story/Story.aspx?guid=%7B79103C23-8DEB-4A7B-AC5C-8945ECE71B6E%7D&siteid=mktw&dist=

How can we have all that net worth and still be doomed?

Funny, for a goldbug like you to make any money you need the government to become more Keynesian in the way they manage the economy. Our annual debt is just 2% of our GDP. If my debt is just 2% of my annual income, am I doomed? Do you realize how unqualified you are to be lecturing anyone about fundamentals?

People like you are the cause of doom and gloom.

Because I won't buy into your goldbug nonsense? LOL.

I simply report the effects of the disastrous policies you and your fellow debt-mongers advocate.

Simple is a good word to describe what you do. At least you're not posting our debt without assets any longer. Is that because you've learned how to calculate net worth?

With interest rates at their lowest level in four decades we've managed to increase our debt to income ratio by a full half a point in the past 10 years. Why does that scare you? Maybe you fear what you don't understand.

How is that possible with the constant rise in the triple deficits?

Great news. This means more people will be able to afford their own home and it has no effect on those of us who already own homes. If we have to move, the lower price we get will be offset by the lower price we have to pay for a new home in a different location.

The only downside here seems to be for speculators who buy houses hoping to flip them quickly for more money. Anyone numb enough to buy at the recent peak prices is realizing the risk they took.

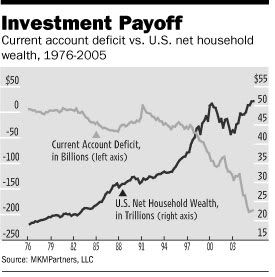

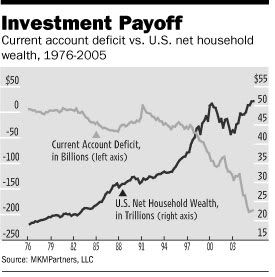

It would appear they are taking their toll has household net worth has been steadily declining every year.

Now read it again and go back to the first cartoon in post #105.

Do you not see the obvious? You've become a water boy for the MSM.

Now look here at page 110.

Household net worth:

2000: $41.371 Trillion

2001: $40.377 " "

2002: $38.820 " "

2003: $43.981 " "

2004: $47.987 " "

2005: $51.811 " "

2006: $52.271 " " (quarter 1)

2006: $53.325 " " (quarter 2)

What is it about this growth that you don't understand? It doesn't travel in a straight line but it's up $12 trillion since 2000 and has nearly doubled since 1995. How does this mean we're doomed?

Net worth, calculated by subtracting liabilities from assets, had increased 13% in 2003, 9.7% in 2004 and 8.5% in 2005

LOL!

bttt

It all depends on where you want to be. If you must be in a metro area, then increased population leads to lower value for the dollar. In parts of Florida, you can get a very nice 2,000+ sqft place on a lake with 1+ acres for $200-300k (prior to 2002, those same places were < $175k). If you don't care about waterfront, prices drop drastically. You can build a 2,000+ sqft house with pool for about $80/sqft, you supply the land. In large metro areas, it would be difficult to even find a full acre and the prices increase with demand.

Net worth, calculated by subtracting liabilities from assets, had increased 13% in 2003, 9.7% in 2004 and 8.5% in 2005.

I don't think we'll see GGG teaching fundamentals at Wharton any time soon. ROFL!

yes, that is quite common in florida. those people are called 'snow birds' and you notice a definite uptick in traffic after Christmas. Florida home prices, compared to up north, are a massive deal.

I don't think Warren Buffett is going to be asking him for trading tips either.

That is, the gains in net worth have been steadily declining every year.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.