Posted on 12/30/2014 11:33:06 AM PST by blam

December30, 2014

John_Rubino

Twelve short months ago, the immediate future looked like a lock. Overvalued equities had to fall, ridiculously-low interest rates had to rise, and beaten-down precious metals had to resume their bull market.

The evidence was overwhelming. Debt in the developed world had risen to $157 trillion, or 376% of GDP, by far the highest level on record and clearly unsustainable. Long-term US Treasury rates had been falling for literally three decades and despite a recent uptick were so low that the only way forward seemed to be up.

Europe and Japan were drifting into recessions that could easily morph into capital-D Depressions. The eurozone would fragment, Japanese bonds and probably stocks would crater, one or more major currencies would implode. No way to know which event would come first and in what order the other dominoes would fall, but without doubt something had to give.

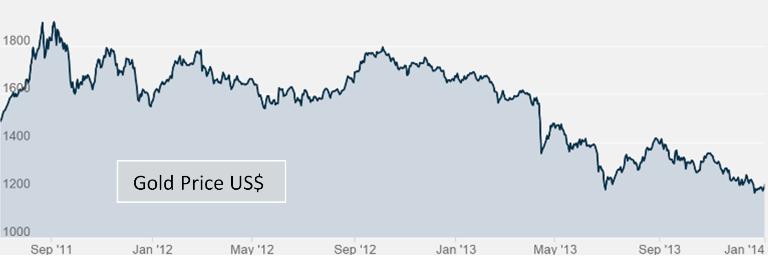

And gold, of course, had had its correction and was, at the beginning of 2014, perilously close to the mining industry’s cost of production. The last time that happened, in 2008, an epic bull market ensued — and gold-bugs were anxious for a replay.

Yet 2014 turned out to be a pretty good year for the powers that be and the economic theories that animate their behavior. Equities boomed, interest rates fell, the dollar soared, and gold ended the year below where it started. Gold miners, after a year of operating at an aggregate loss, have seen their market values crater.

(snip)

(Excerpt) Read more at marketoracle.co.uk ...

Been hearing this for a couple decades now, and it makes sense, but...that doesn't seem to matter...somehow the markets continue to be propped up, as previously mentioned, by the gubmint printing press. This can't last forever either, or can it? I mean, really...all conventional economic wisdom seems to be flying out the window.

Predictions are hard. Especially about the future.

Look at what oil has done as well, no one saw that coming either.

(What do you call oil speculators anyway, Lubers?)

It is almost certain that the price of gold will do one of two things next year. It will either go up or it will go down. There is a slight possibility that it will stay exactly the same.

Anyone who tells you that they know what the price of gold will be at the end of next year (or next month or next week) is lying. If I knew which way it would go I would be a billionaire by the end of the year.

I think the piece we don’t consider is the decreasing purchasing power of the retiring boomers with too few people to replace them. Lower consumption means deflation. Even with massive quantitative easing it’s not enough.

$1,000 worth of gold bought in 2000 is worth about $3,600 today. Silver about $3,000.

That’s very true. Governments often take radical measures to artificially prop up economies. That makes things less predictable. However, we are in a special situation because we are the world economic leader and our currency is... the gold standard, if you will... that so many things are pegged to. Eventually though our national debt will eat us alive and no matter what our economic output and no matter what the government does (printing, etc...) the rest of the world will begin to look askance at us. It’s already happening. I don’t know if the dollar will be abandoned in an orderly fashion or in a tidal wave, but the way we’re going now it is bound to happen. That will severely devalue the dollar and there really is nothing the fed can do about it. At that point I think gold and silver will be a good insurance policy.

It’s also handy as a barter item should the SHTF (EMP weapon, power grid hack, etc...). Gold, silver, booze, food, water and ammo.

Agreed. And I hope it stays a 'poor' investment - because otherwise it means that the other investments have burned down and it is time to break out the insurance policy. Insurance is good to have - but you really hate to have to use it.

I’m beginning to think nothing big will change in my lifetime with the exception of us coming under a dictatorship. We’re almost there already.

There will be a one world government, but since I’m turning 64 this year I doubt I’ll live to see it.

Economic crash? I’ve come to the conclusion the world is too big to fail. The “powers that be” are not going to allow themselves and their kids and grandkids to live in a Mad Max world. I do believe the rich will get richer and the poor will get poorer. That’s happening every day.

I’ve got some silver. I wish I had the cash I used to buy it.

The fact remains that the value of gold is and always will be manipulated just like stocks.

Very few people will ever have any practical use for physical gold, and it’s value beyond that is no greater than dollars or stocks.

My wife and I are those retired boomers you speak of. Our purchasing power is gone. But we’re still a lot better than a lot of people because we can tread water.

India used to be the world’s number one importer of gold. India began restricting the importation of gold in 2013 and I believe they have a total ban in effect right now. That has certainly reduced the demand side.

Some gold bugs spin plausible stories in order to sell gold. There’s little necessity for owning gold so demand is going to be elastic to say the least. People buying gold in January 1980 were convinced that it could only continue to go up. They had to wait a very long time just to break even.

Who thought this, in the middle of a raging equity bull market? GoldLine salesmen and Glenn Beck perhaps. Ridiculous. I've been telling FReepers since Feb 2009 to buy, buy, buy, on the way to Dow 20k. Dollar also will rally more, and get to parity w Euro. The fun has just begun.

Which is why you must focus on technicals not fundamentals. It does not matter "why" -- it just is. Invest on reality, not idealism.

If you had bought $1,000 of Tesla Motors stock 2 years ago it would be worth $8,300 today

So when do you get out. You better have a technical time to do that, or you will be caught in the 1929 replay.

Why? It's a shiny metal. It's got no more intrinsic value than does green inked paper. You can't eat it. It's probably got less industrial uses than paper.

"Gold cannot be inflated to worthlessness, paper currency can be.

During the California gold rush, Gold have serious inflation problems. But for the most part, you are right, short of finding a massive gold deposit, gold is largely immune to inflation. Which means using it as a basis for currency almost guaranteeds deflation, and the deflationary depressions that go with it. When we were on the gold standard we had severe business crippling depressions every 20 years. Thank goodness for fiat currency.

The inflation on our fiat currency has been well managed in the past and averaged only about 2% a year. Of course if you look at a 100 year chart that looks terrible. But it really should be scary only to idiots hoping to hoard cash for 100 years in their mattress and not even draw interest.

Gold cannot be declared worthless or "reverse split" by government fiat, paper currency can be.

Sure it can. Our own government even outlawed gold at one point and consficated it. Every time the government had a major war they came off the gold standard. So a gold standard will always exist only at the whim of Congress.

"Gold maintans its purchasing power over centuries, paper currency always goes to zero purchasing power. Gold is real money, paper currency is currency and there is a difference.

Money is whatever we say it is. Whatever facilitates the trade. There is no difference in gold, paper, or electronic blips.

Gold has intrinsic value, paper currency does not.

Gold has some intrinsic value, but not much. You can make some electronics with it better than with other materials. Pretty much every other use of gold is driven entirely by supply and demand. People want gold jewelry instead of aluminum because of gold's extrinsic value (i.e., people want gold jewelry more than they want aluminum jewelry because they just do).

Gold cannot be inflated to worthlessness, paper currency can be.

Gold can be inflated to worthlessness if any of the gold producing countries decide to dump a ton of gold on the market all at once.

Gold cannot be declared worthless or "reverse split" by government fiat, paper currency can be.

Gold cannot be declared worthless by government fiat, but it can be made almost worthless if a country has a ton of gold and dumps it on the market. Also, gold can be made almost worthless for most people in the U.S. by government fiat if the government makes it illegal to own, buy or sell it (which it has done in the past).

Gold maintains its purchasing power over centuries, paper currency always goes to zero purchasing power.

Gold has maintained most of its purchasing power, but the price of gold has fluctuated a hell of a lot over the past centuries.

Gold is real money, paper currency is currency and there is a difference.

There is a difference, but again not that much. Gold has value because people want it. The price is entirely a function of current supply and demand. Massively increase the supply or prohibit ownership and cut demand and most of its value will be gone.

I don't look at physical gold or silver as an investment. Holding physical gold and silver is an insurance policy.

I agree with you 100% on this. I think everyone should own some gold, along with some silver and other commodities, real estate, mineral interests, stocks, bonds and cash. The key is diversification.

If you want to invest, put your money into things that earn more money - company stocks, productive land, mineral interests, etc.

If you want to protect yourself as much as possible from the inevitable economic downturns, depressions and/or financial armageddon, then also put some of your money in gold, silver and several other commodities.

If you invest in commodities hoping to make money by correctly betting whether they will rise or fall in value, then you would do better going to Las Vegas and betting on red or black on the roulette wheel. At least in Vegas you can also get drunk and take in a show.

I buy both every so often.......if I can’t sell this in 20yrs to finance something or other, I’ll just leave it to my kid and let her sell it.

I started buying it as soon as BO was elected to protect against him, now I do because I like some of the coins and turns out some hold good value.

We are instead in an era of "financial repression" in which the Fed and the US Treasury and the G-8's other central banks are deliberately keeping interest rates low in order to manage the carrying costs of the massive public debts racked up by the their governments.

In addition, the tightening of financial regulations increasingly directs large pools of investment cash into the purchase of government debt and away from equities and commodities and corporate debt. Finally, the lack of tax cuts has diminished economic growth and implies greater austerity in the years to come.

In such an environment, money velocity is down due to an increased preference for the holding of cash and cash equivalents. Thus much of the new money created by the Fed does not go into the purchase of new goods and services so as to spur inflation.

Most notably, oil -- the central commodity of the modern world -- has declined in price due to the development of oil shale fracking in the US, a relatively weak world economy, and tensions between Saudi Arabia and Iran. Yet such factors are facilitated by the US financial regime that is suppressing inflation despite the Fed's massive dollar creation in recent years.

The recent declines in the gold price further signal that the world is recognizing that catastrophic inflation is not in the offing. That is too bad for gold bugs -- but good for the rest of us.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.