JPMorgan Chase

Total Assets: $2,476,986,000,000 (about 2.5 trillion dollars)

Total Exposure To Derivatives: $67,951,190,000,000 (more than 67 trillion dollars)

Citibank

Total Assets: $1,894,736,000,000 (almost 1.9 trillion dollars)

Total Exposure To Derivatives: $59,944,502,000,000 (nearly 60 trillion dollars)

Goldman Sachs

Total Assets: $915,705,000,000 (less than a trillion dollars)

Total Exposure To Derivatives: $54,564,516,000,000 (more than 54 trillion dollars)

Bank Of America

Total Assets: $2,152,533,000,000 (a bit more than 2.1 trillion dollars)

Total Exposure To Derivatives: $54,457,605,000,000 (more than 54 trillion dollars)

Morgan Stanley

Total Assets: $831,381,000,000 (less than a trillion dollars)

Total Exposure To Derivatives: $44,946,153,000,000 (more than 44 trillion dollars)

Its only money in a computer. Just move the decimal a couple places over and yer fine.

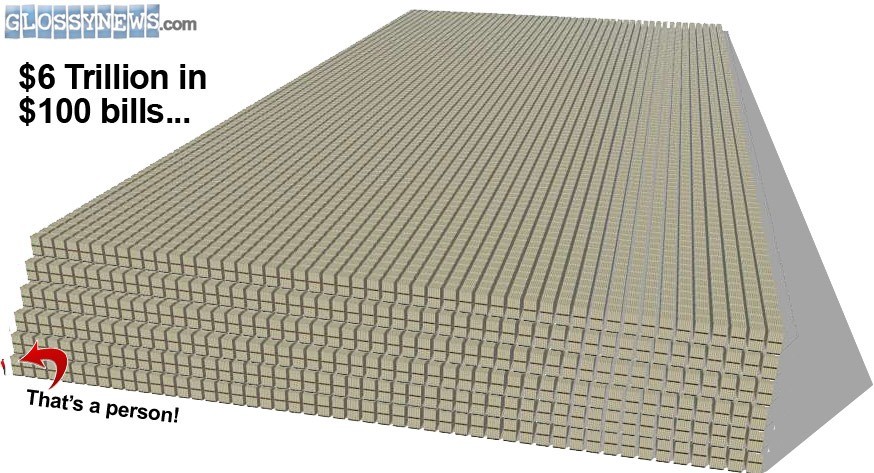

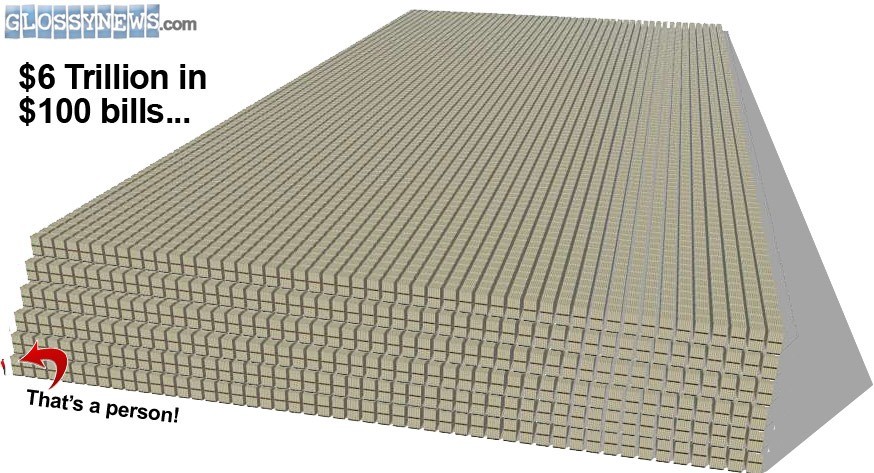

that amount of money in $100 bills is more than TWICE the width and height of the World Trade Center.

I saw a program about it, trying to give people a way to imagine it.

The Reader’s Digest version is that there is a black hole of paper debt exceeding the total appraised value of all material things ever created by mankind by several orders of magnitude floating out there in the form of binary digits waiting to implode under it’s own enormous mass, which will surely take the whole global economy with it when it does.

Derivatives are betting on a bet on a bet and so on and also trying to game (cheating) the system so the bet comes out your way. However the others involved are also gaming (cheating) the system. The taxpayers end up the loser just like the S&L and real estate scams.

Robert Rubin - A culprit - perhaps the main culprit. Quote from link below:

“As Clinton’s two-term Secretary of the Treasury, Rubin sharply opposed any regulation of collateralized debt obligations, credit default swaps and other so-called “derivative” financial instruments which—despite having already created havoc for companies such as Procter & Gamble and Gibson Greetings, and disastrous consequences in 1994 for Orange County, California with its $1.5 billion default and subsequent bankruptcy—were nevertheless becoming the chief engine of profitability for Rubin’s former employer Goldman Sachs and other Wall Street firms.[32] When Brooksley Born, head of the Commodity Futures Trading Commission, circulated a letter urging increased regulation of derivatives in line with a 1994 General Accounting Office report, Rubin took the unusual step (for a Secretary of the Treasury) of going public in June 1998 to denounce Born and her proposal, eventually urging that the CFTC be stripped of its regulatory authority.”

http://en.wikipedia.org/wiki/Robert_Rubin

Translation: U.S. CITIZENS have more than 40 Trillion Dollars In Exposure To Derivatives

This county cannot afford a repeat of 2008.

What Cooked The World’s Economy?

http://www.freerepublic.com/focus/f-news/2209313/posts

And...

Here’s the link for the evidence in the information from the “Bank for International Settlements,” as mentioned in the full version of the excerpted article linked above.

http://www.bis.org/publ/otc_hy0805.pdf

...and a quote from it.

“The over-the-counter (OTC) derivatives market showed relatively steady growth in the second half of 2007, amid the turmoil in global financial markets. Notional amounts of all categories of OTC contracts rose by 15% to $596 trillion at the end of December (Table 1), following a 24% increase in the first half of the year.1”

More on what happened in 2007-2008.

China’s imploding US ally (AIG)

http://www.freerepublic.com/focus/f-news/2084468/posts

AIG: Inquiring Minds Want To Know

http://www.freerepublic.com/focus/f-news/2192489/posts

(China)

Fed won’t say who helped by AIG rescue

http://www.freerepublic.com/focus/f-news/2200398/posts

Top U.S., European Banks Got $50 Billion in AIG Aid

http://www.freerepublic.com/focus/f-bloggers/2201213/posts

China appeals to Washington to safeguard assets

http://www.freerepublic.com/focus/f-news/2205693/posts

U.S. Federal Reserve to buy up to US$300B long-term Treasury bonds

http://www.freerepublic.com/focus/news/2209403/posts

Should derivative be made illegal? They’re turning betting into an asset in which they could trade it with others. It feel almost like a ponzi scheme

All D-F did was make small, local banks more vulnerable to be gobbled up by the majors, and make the average American citizen a terrorist suspect every time they deposit or withdraw money.

Where is Chris Dodd anyway? Probably on some exclusive beach with Jon Corzine.

It’s actually far more than 500T that is exposed according to the CFTC and Director Brooksley Born. Watch:

http://www.pbs.org/wgbh/pages/frontline/warning/interviews/born.html

And look what John Boehner did in June of this year:

The derivatives exposure is a bomb that the banks threaten to blow up the American economy with if they are not obeyed. They are holding a gun to the USA’s head.

We have a war to fight with banksters either now or later but it will happen. Our lives will get scary but without defeating this current crop of banking criminals we are destined to lose freedom.

This is the end game.

All of the news of ISIS, Putin and China is a distraction. It is the criminal network that controls the international banks that is the real enemy.

Look at how Congress has been bought and paid for. There is effectively no representation in Congress for Americans. All legislation is prioritized according to what banks demand. There are no bills passed that focus on reforming government to get it off the backs of ordinary Americans or that promote America’s exceptionalism or add to its border security, and so on. The Bills that pass are not for Americans, they are for international corporations.

How did the banksters seize control? Repeal of Glass-Steagall and the Bush family are the primary causes.

American banks have nearly $280 trillion of derivatives on their books, and they earn some of their biggest profits from trading in them.

...

Oh geeeez, not the notional value accounting nonsense again.

“Margin call, gentlemen.”

No big deal. The government will bail them out and Obama can say he saved the economy again. Obama’s stash is limitless.

bkmk