On a trend projection basis we might get there around 2024.

We just finally got out of the Obama recession.

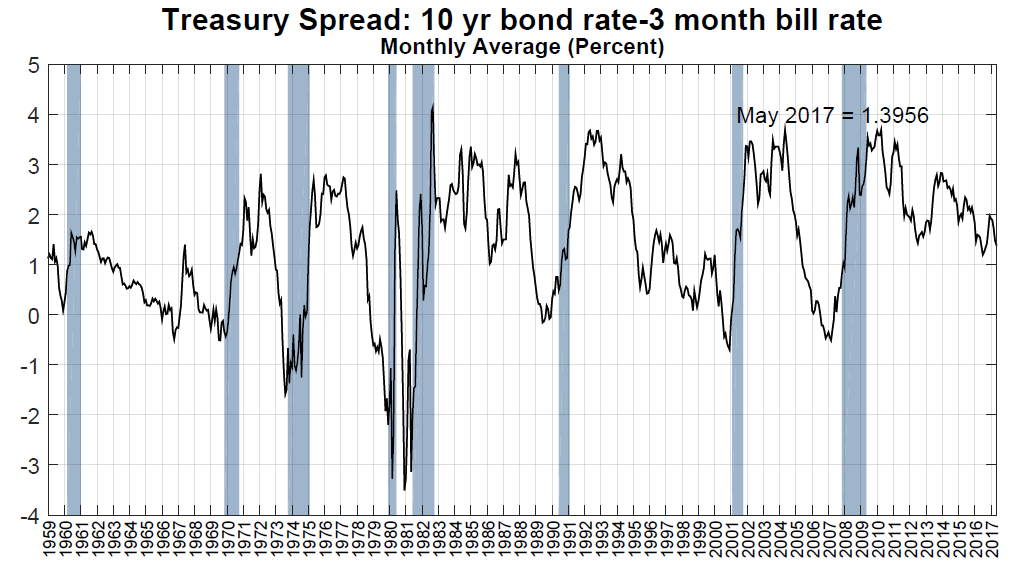

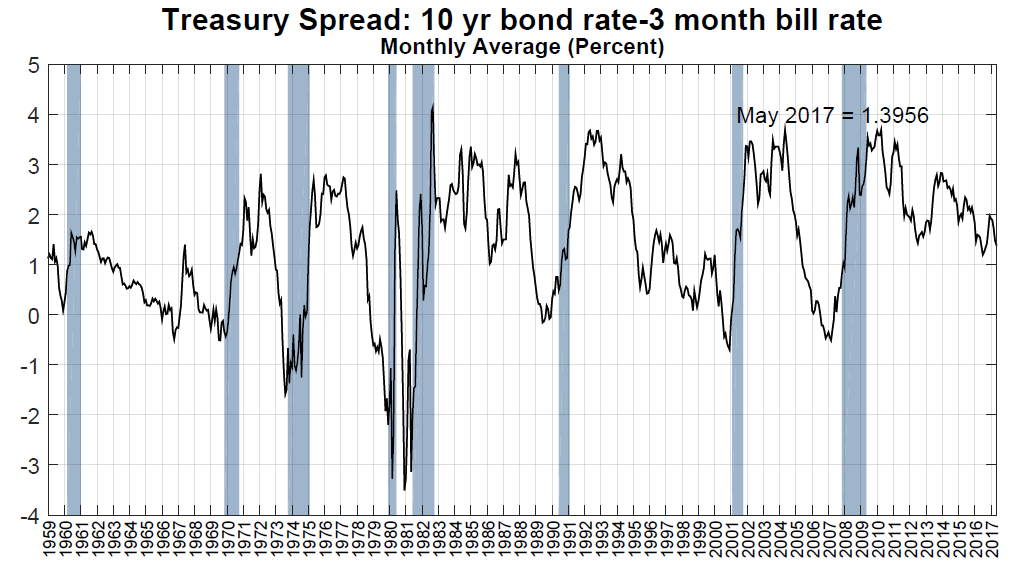

The reason I am posting this is because it is truly fake news. The yield curve often gets close to inverting without ever actually doing so. Watch the 1 year vs. 10 year spread. That’s the only one that has ever had any empirical validity. If THAT goes negative, then we should be concerned.

In the meantime, no danger signal of a coming recession - unless you’re a democrat.

There is always someone looking for attention.

Some economists are worried about the bond curve “inverting,”

Some hollywood actors are worried that exhaling will cause the earth to explode in a ball of fire.

seems to be a lot of worrying going on, why??

We are one and a half or two years away from that possibility

The statistic they are th about has been this way for several years.

This, coupled with a low business tax (and even lower repatriation tax) will be a beautiful thing to behold.

Possible, but not likely since stock prices on bonds carrying a low interest rate will necessarily fall as the economy heats up. Stock & bond prices tend to move in opposite directions.

On a trend projection basis we might get there around 2024.

Got it: fake news.

Would appreciate if someone could speculate about upcoming changes to the money velocity...

Waiting in the wings: fear of the economy over-heating because it is being over-stimulated.

Too much of a good thing.

:)

Excuse me while I guffaw, and wish everyone a Merry Christmas , and a Prosperous New Year!

These Keynesian economists are trying so hard to follow the tax cuts with some kind of bad news to worry about instead of the tremendous overall effect. These guys are like the blind leading the blind.

Here’s what to look for. Usually significant tax cut initially could have a recessionary effect like a drunk coming off alcohol cold turkey, like what happened initially with the Reagan tax cuts. Watch heads of the Left and these confused Keynesian economists’ spin with delight as they did with Reagan. But in a while, as with Reagan, so here, the economy will blast off, even from the very small cuts made. Watch how the Left and these confused Keynesian economists ignore the economic boom as they did with Reagan. They are so predictable. Forget about these idiots and enjoy the ride.

This should only be the first shot over the bow. What would happen if they REALLY SUBSTANTIALLY cut taxes - NO “corporate tax” (a hidden individual tax) and individual flat tax at 10%-15%. Our economy would explode as never has been seen before. It pray it will happen.

My brother, a finance industry professional, has been worried that Obama’s loyalists at the Fed will ratchet up interest rates too fast and too far in order to sabotage Trump.

I’m concerned about inflation. No reason ‘cause I’m sure not an expert.

Wal-Mart sales performance is a much better and more accurate predictor of where the econ is going. I don’t even look at bond curves anymore.

Correlation is not causation. There HAVE been times when the fed cranked up short term rates so much they helped cause a recession (think Volker) But thatis light years different than our current low interest rate, long and weak recovery situation.

Wishing you all much happiness and prosperity in 2018. Thank you for getting me through the previous 8 year nightmare!!!