Yes, and the FED has printed about 80% of ALL the dollars ever printed in the last 2 years

Posted on 08/20/2022 7:45:40 PM PDT by Mount Athos

Russia’s economy shrank by 4 percent year-on-year over the second quarter, according to data published by Russian federal statistics service Rosstat. The plunge, though significant in absolute terms, was not as drastic as expected by Russian and some Western observers. “June data suggests the contraction in the Russian economy seems to have bottomed out as the situation in some industries is stabilizing,” Sergey Konygin, an economist at Sinara Investment Bank, told Reuters.

Hungarian prime minister Viktor Orban claimed in a speech last month that the European Union’s sanctions strategy against Russia has failed. “A new strategy is needed which should focus on peace talks and drafting a good peace proposal … instead of winning the war,” he said. Orban said the West’s strategy was built on four pillars—that Ukraine can win a war against Russia with NATO backing, that sanctions will hurt Russia more than Europe, that the rest of the world will support Western punitive measures against Russia, and that sanctions will critically weaken Russia. “We are sitting in a car that has a puncture in all four tires. It is absolutely clear that the war cannot be won in this way,” Orban said.

The latter three “tires” have created a constellation of unexpected challenges for the Western sanctions regime.

Russia’s Central Bank took swift measures in the wake of the Ukraine invasion to shield the ruble from a flurry of U.S. and EU financial restrictions. Far from being reduced to “rubble,” as President Joe Biden proclaimed in March, the ruble became one of the world’s strongest performing currencies this year.

Even as Moscow takes unprecedented macroeconomic steps to contain the damage from sanctions, Russian policymakers are honing their tools to evade or otherwise mitigate specific punitive measures. Citing a running list maintained by Yale University’s Chief Executive Leadership Institute (CELI), proponents of the sanctions regime have noted that over 1,000 companies have “curtailed operations” in Russia.

Though the Western-led financial pullout from Russia appears overwhelming in sheer scale, the reality on the ground is rather more complicated. Russian authorities have successfully enabled a wide range of “parallel import” schemes, according to a recent report by DW. From Levi’s jeans to Apple iPhones, numerous common and luxury products continue to be available for purchase in Russia’s metropolitan centers despite the fact that these manufacturers are no longer directly supplying Russian markets. Such goods typically arrive in Russia by way of unauthorized imports from entities based in former Soviet countries including Kazakhstan, Belarus, and Armenia.

Moscow has opened the floodgates to such activities by lifting restrictions on the resale of many types of goods purchased abroad. These transactions, also known as gray market sales, have totaled $6.5 billion since May, and are expected to reach $16 billion by the end of the year, according to Deputy Prime Minister and Minister of Industry and Trade Denis Manturov. Other products and services also continue to be available through rebranding and knockoff ventures. McDonald’s and Starbucks, both of which ceased operations in Russia in the months following the invasion of Ukraine, have been replaced by successor companies that offer nearly-identical products with similar branding. Courts would normally put a swift end to such obvious copycat enterprises, but Russia’s legal system is in no mood to lend a sympathetic ear to the patent and infringement claims of Western companies at a time of unprecedented hostility between Russia and the West.

Perhaps the greatest long-term challenge to the West’s campaign to squeeze Russia over its invasion of Ukraine is the fact that the world’s great economic powers have not only refused to join the Washington-led sanctions regime but continue to deepen their trade and financial ties with Moscow. Both India and China have intensified the pace of their energy imports from Russia over the past half year. There have been credible reports of the former selling refined Russian oil to European and U.S. importers. Russian earnings from energy exports skyrocketed following the West’s sanctions barrage earlier this year.

Experts say the effects of sanctions on Russia could take years to fully manifest. Even then, there is no guarantee that the forecasted economic stagnation will occur on a sufficient scale to starve the Kremlin war machine or otherwise produce meaningful, positive changes in Russia’s foreign policy. Moscow, driven by the conviction that its existential interests hinge on victory in Ukraine, believes it can outlast the West economically and on the battlefield. Russia has so far largely managed to mitigate the pain from sanctions and is shifting its strategy in Ukraine from trying to quickly seize major cities to bleeding Ukrainian forces white in a grinding war of attrition.

European consumers, meanwhile, are reeling from sky-rocketing heating and electricity bills as officials scramble to contain the energy crisis unleashed by what experts have described as the EU’s poorly conceived plan to transition away from Russian energy imports. With Germany reportedly teetering on the verge of a recession, Europe’s mounting economic challenges have reignited concerns that EU states could start peeling away from the Western sanctions regime. Even before Russian energy giant Gazprom formally threatened to cut European customers off from gas supplies, polling showed that a majority of Europeans—including 49 percent of Germans—favored policies aimed at facilitating a negotiated settlement rather than Russia’s clear defeat. As the war drags on with no end in sight, these growing trends risk splintering the West’s united front on Ukraine sooner than the sanctions regime manages to take a decisive toll on Russia’s economy.

This is a couple of months old but still informative.

Sanctions on Russian Oil Drive Restructuring of Global Supply Chain, India and China Benefit

By Anne Zhang June 28, 2022

https://www.theepochtimes.com/special-report-sanctions-on-russian-oil-drive-restructuring-of-global-supply-chain-india-and-china-benefit_4563097.html

In a word: Yes.

It has not altered Russian policy and has caused more harm to Western countries than it has to Russia. That is the very definition of failure.

You want to push India into the Russia-China camp? Your suggestion is an excellent way to do just that.

India is a huge country and a budding superpower. Having come from a colonial past they are not about to let themselves be pushed around by threats/blackmail. That is especially true if it comes from Western countries.

Yours is the most shortsighted and self defeating idea I can imagine. It would push India toward siding with Russia and China and the combination of those 3 aligned against the West would be more than we can handle.

A smart policy would be to end this reckless and stupid idea of antagonizing Russia completely unnecessarily, getting India on side (as Trump was doing building the Quad) and containing China while we disentangle ourselves from China economically. Pushing first Russia and then India into alliance with China against us would be the single stupidest most self destructive thing we could possibly do.

Lol, Biden’s Commerce Secretary passing on Ukrainian intelligence reports to a Senate committee, reported on by the Washington Post. That’s some solid gold trustworthy stuff right there, evidence of the genius and effectiveness of Pedo Joe’s policies.

“War games” = a sniper competition.

The RIC in BRICS stands for Russia, India, China so no big surprise there.

Wait - whut?

It’s only been 6 months since the invasion began - and if anything, Russia is raking in the dough because idiots like Biden keep telling us they’re doing everything they can while making things worse.

Yes, and the FED has printed about 80% of ALL the dollars ever printed in the last 2 years

“ the FED has printed about 80% of ALL the dollars ever printed in the last 2 years”

You have inverted that. It was 20% of the money supply created during the COVID surge. That was an inflationary stimulus.

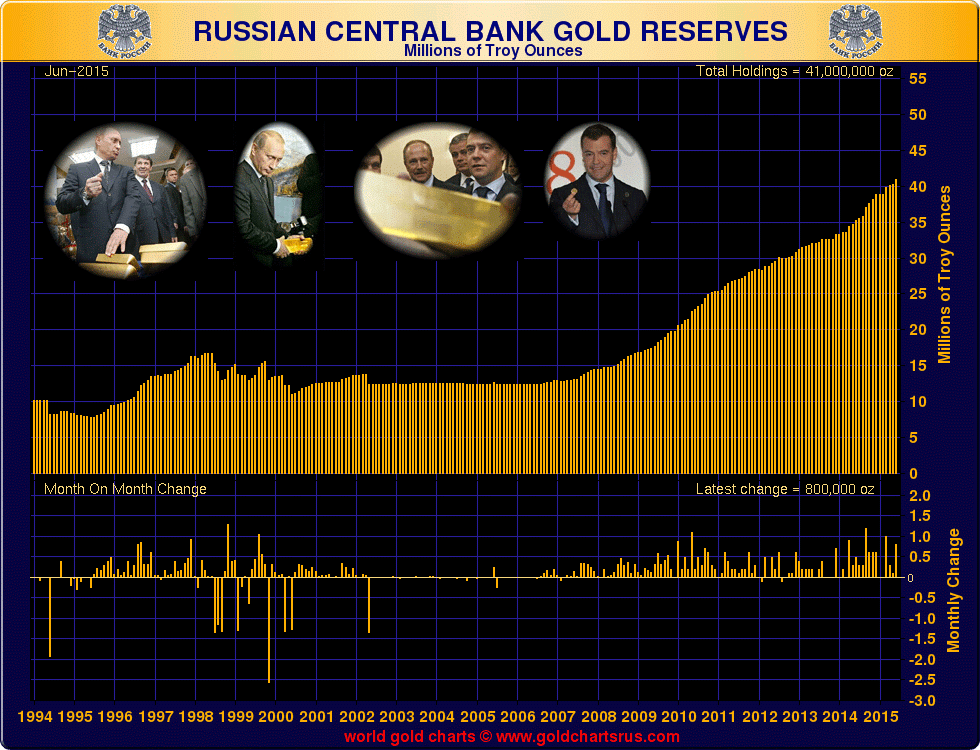

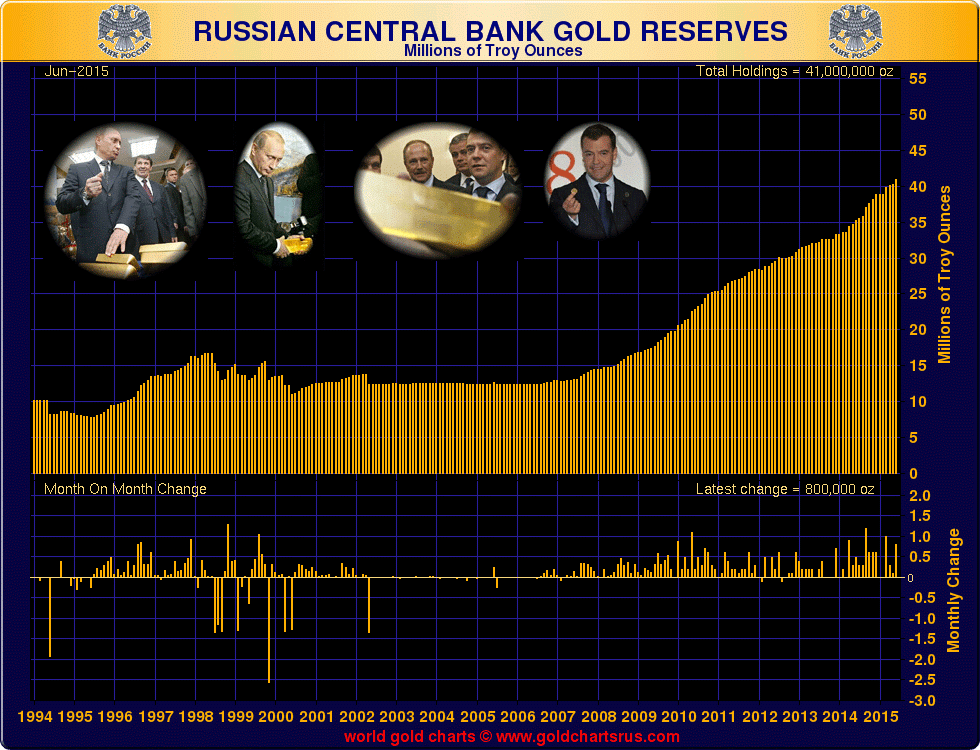

Your chart of Russian gold reserves shows an increase of about 25 million Troy ounces, or around $50 billion.

Russia has been burning through about that much per month during this war.

A lot of their National Wealth Fund, from which pensions are paid (like Social Seccurity checks in the USA), was invested overseas - now mostly frozen.

It is Print, Print, Printity, Print; from here on out. Hello Argentina (or Zimbabwe) for a currency, and Hello North Korea for an economy.

Putin did that.

He drove the Russian economy and standard of living over a cliff. It is on track for 2-3 years of continuous train wreck, to a much much lower level.

Ummm.... what's is a "$50 billion"? Billion what? Fiat? That's for all intents and purposes worthless, given that Russia is moving away from fiat, and to PM-backed currency, along with BRICS+. How much gold is behind that $50 billion? I mean in physical, not paper...

“ Ummm.... what’s is a “$50 billion”? Billion what?”

That is fifty billion dollars that can actually write checks and buy things in the real world that we live in.

The point is that Russia raised its gold reserves over the last decade a lot in percentage terms, but not in absolute terms.

$50 billion in gold is not going to pay Russia’s growing bills for long. It can cover their current gap for about a month - if it has not already been transferred to new owners, during the fire sale of recent months.

So they print away, and issue bailouts each month to firms that would already be bankrupt, because of the sanctions, like Aeroflot Airlines, and their whole auto industry.

Russian (M2) money supply, in Terms of US dollars:

May 2022: $1,093

June 2022: $1,361

$268 Billion dollars worth of rubles created in that month’s reporting alone. About a 25% expansion in that month - more than the roughly 20% expansion of the US dollar supply, over two years of the COVID money printing spree.

$50 billion dollars worth of gold is a drop in the bucket, of Russia’s current burn rate. It took Russia several years to accumulate that much gold.

Russia is speeding over a financial cliff.

Putin did that.

I have read elsewhere Russia is selling oil to India and China at bargain basement prices. Then India is reselling to EU countries at a profit. In that case these transactions would be hurting Russia and helping India, and although costing EU countries more, also helping them build reserves while costing Russia. Perhaps India could be persuaded to reduce costs to EU while still making money doing this.

Russia is saying their 2nd Quarter economic value dropped 4%, and third Q is expected to drop about 7%. So sanctions are beginning to be felt. If the following 2 quarters also drop by 7%, That could become 25% for one year. Even if less it is still not a promising outlook. If they still have shortages of computer chips and quality ball bearings, then reduced production will continue to damage the GDP. Lower production and unemployment will continue to hurt workers and landlords, and taxe revenue. See link below.

https://tradingeconomics.com/russia/gdp-growth-annual

It will be interesting to see what happens to oil prices this next year. In US, West Texas Intermediate (WTI) is currently trading just under $90 a barrel. If this holds, then some of the pricier fracking wells may be put back into pumping, , and new drilling. So far US producers have been waiting to see how the market shakes out as they raise prices and enjoy elevated profits. If there develops a trend downward in world prices this would not be good for Russia.

...demand India follow the sanctions or face

its own sanctions from the west.

_________________________________

Not sure anyone has the juice to make that sort of demand of anyone not already totally bought and willingly self-sold.

It appears as though the multi-polar world is already existent. It was, after all, the WEF-controlled Atlantic Alliance which chose first to use Ukraine as a catspaw and then decided to levy sanctions on Russia. Neither the US not the EU is refraining from purchasing energy from Russia. They are simply jumping thru more hoops and paying more to Russia on Russia’s terms. US & EU manufacturers are knowingly shipping goods to countries that openly trade with Russia. None of this is a secret.

The entire world is choosing sides and multi-polar alliances of sovereign nations w/sound, commodity-backed money, minus WEF (et al) is a clear favorite over devalued Euros or valueless FRNs that come from WEF-controlled Central Banks issuing fiat (debt coupons) that comes with a centralized global government.

Western state legacy media tells its captive audience what the Brits call *huge porkies* about Central Banks, the actual informational/economic state of the world and the amount of clout possessed by the occupied Atlantic Alliance (including occupied Australia & NZ as Pacific members, via the AngloSphere).

Countries who still have choices are making theirs known.

This is a cautious personal opinion subject to change, but humanity might just be able to save itself from this catastrophe.

If the goal was to hurt Western economies then they are working great.

_______________________________________

Corporate states are notoriously eager to meet several goals from a single action. They are historically famous for their efficiency.

Since they are not stupid, but are filled with hubris, it is a good bet they were aware of many different results and are just fine with how it’s shaking out.

Winter is coming.

_________________________

German PPI is already up 37% vs a year ago.

Russia has been burning through about that much per month during this war.

_____________________________

So, Russia has no current accounts? No trade at all with the entire globe? No resources, manufacturing, domestic markets or internal value-added profits?

Reserves are just that. In reserve.

And the value of gold is being suppressed by the usual suspects, but we all know the pressure is building.

Russia is the 2nd largest gold producer on the planet. The Atlantic Alliance is dawdling (because they know more sanctions will yield the same results) over making sanctions on Russian gold more draconian, but it is symbolic, as the trade simply shifts to Asia.

“So, Russia has no current accounts?”

They have a current account (trade) surplus, mainly because the price of their oil and gas exports rose, while their imports dropped a lot due to sanctions.

Since they are now demanding payment in Rubles, they are not accumulating foreign currency, but still having to spend it for a lot of the imports that they still can get. They are burning through their remaining reserves of foreign currency, after which imports will likely decline somewhat further. They will still be able to barter with oil for some.

Gas export volumes continue to drop, with no where else that gas can go.

Oil prices are down 25% from their wartime high. Secondary sanctions on other customers (India and China) are being planned for December. If oil prices drop to their pre-COVID norms (around $60), it would be a dire financial situation for Russia.

Yes they produce gold and diamonds, but that is just a fraction of the revenue that oil produces.

Russia is more dependent on oil and gas (1/2 their GDP, about 1/4 each for gas and oil) than Saudi Arabia (1/3 of GDP). The EU bought 85% of their gas exports. Most of that is now going away quickly, for good, and with no other way to any other market.

When the oil price gets kicked out from under them, they will be left swinging.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.