Posted on 03/25/2024 1:35:01 PM PDT by Heartlander

In case you’ve still got money in a bank, Bloomberg is warning that defaults in commercial real estate loans could “topple” hundreds of US banks.

Leaving taxpayers on the hook for trillions in losses.

The note, by Senior Editor James Crombie, walks us through the festering hellscape that is commercial real estate.

To set the mood, a new study predicts that nearly half of downtown Pittsburgh office space could be vacant in 4 years. Major cities like San Francisco are already sporting zombie-apocalypse downtowns, with abandoned office buildings baking in the sun.

So what happened?

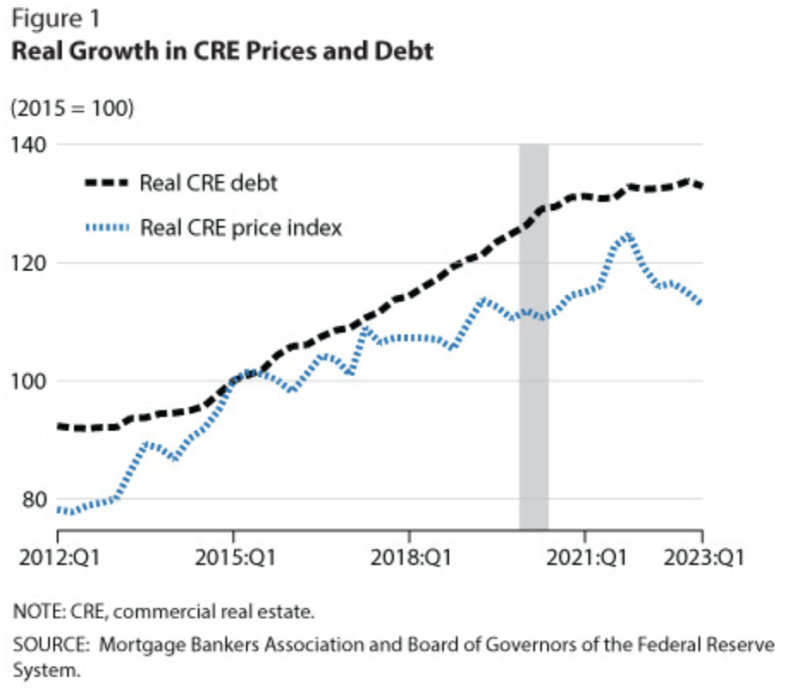

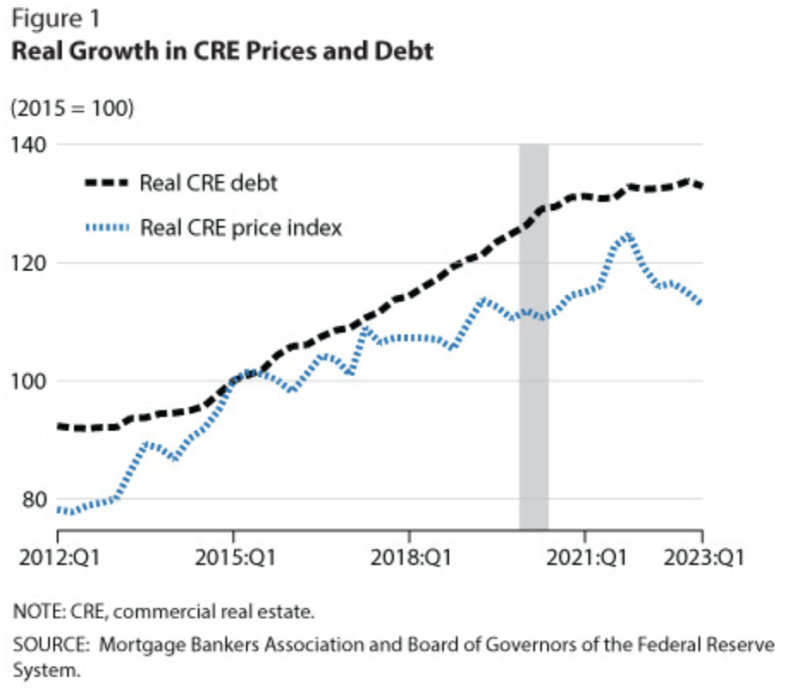

The Fed’s yo-yo interest rates first flooded real estate with low rates and cheap money. Which were overbuilt.

Then came the lockdowns, which forced millions to figure out new workday patterns. People liked foregoing the long commute (not to mention the free money). Despite every effort, downtown businesses have not been able to get all workers back.

These days, everyone talks about hybrid models of working, some in-person and some remote. But judging from observation, remote is winning. In any case, even a 30 percent reduction in the footprint of office space once the leases are renewed could topple the entire sector.

The restaurant and retail sectors of downtown feel the pinch, with more closures all the time. Adding to the pressure are absurd levels of inflation and ever-riskier streets on matters of personal security. Put it all together and there is ever less reason to slog to the office.

When the Fed panic-hiked interest rates in the 2021 inflation, that put trillions of commercial real estate underwater even without other factors. Add to that crime, inflation, plus remote work, and you have a dangerous mix that could toppled cities as we know them.

This could mimic and elaborate upon last year’s bank crisis, where falling bond prices panicked depositors. That crisis only stopped when Treasury Secretary Janet Yellen and Fed Chairman Jerome Powell effectively bailed out every bank in America with sweetheart loans written on fictitious asset values along with unlimited taxpayer guarantees through the comically underfunded FDIC.

By the way, the FDIC is essentially guaranteeing over $20 trillion in deposits on just over $100 billion. So they’ve got a half-penny on the dollar.

Without those government pre-bailouts, one paper last year by researchers at Stanford and Columbia estimated that 1,619 US banks – about a third of them – could be at risk of failure.

The problem is that nothing was actually fixed. In fact, it’s getting worse. For the simple reason that as the months roll by there’s more and more debt coming due.

And that brings us to Crombie, who notes that there’s $929 billion of commercial real estate debt coming due in the next 9 and a half months.

That’s up 28% from last year, and it’s getting bigger every day as banks pretend loans are still healthy by effectively adding missed payments.

We’re starting to see glitches in the matrix; New York Community Bank just went through a near-death experience over its garbage portfolio of commercial real estate loans, dropping almost 80% before it was bailed out by vulture investors while the megabanks hover like megavultures.

More will come. Potentially a lot more: a recent study from the National Bureau of Economic Research estimated that up to 385 American banks could fail over commercial real estate loans alone.

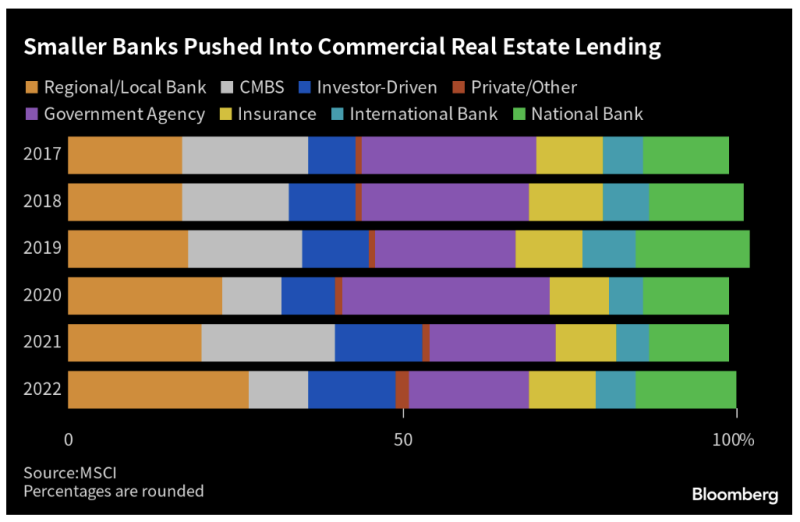

These would overwhelmingly be small regional banks, who typically hold a third of their assets in commercial real estate loans.

They hold so much because they know their local markets best, but the Fed poisoned that chalice by flooding easy money to developers.

For now we’re only seeing the sickest banks dropping out of the herd. That could dramatically accelerate as that $1 trillion plus in loans come due.

Commercial real estate delinquency rates have already jumped to 6 and a half percent – up 30% in a matter of months. Rates of distress in office loans just hit 11%.

When the smoke clears, we could lose dozens, even hundreds, of regional banks. Going by the last time with savings and loans, taxpayers ate 80% of the losses.

Meaning you could be on the hook for trillions, while the megabanks gorge on the carcass.

Slashing interest rates could staunch the bleeding. But with inflation marching up every month – currently at 5 and a half percent annualized – that’s not going to happen.

It would be fun to watch them trying to evict homeless and illegals from Dump Tower.

Conversion is NOT cheap, so it requires loans.

And then what? Buying commercial buildings no one wants to work in located in cities that people are leaving and are crumbling isn't exactly a good buy, no matter how cheap. The entire American landscape is changing as people are fleeing the cities and moving to rural areas.

China is currently mid-crash in its own real-estate crisis. One company, Evergrande, collapsed with $300B in debt. That is half of what Lehmen lost ($613B). 34 of their 50 largest developers that issue bonds are in default. Chinese development bonds have lost 87% of their value in the last 24 months. China will NOT be passing the US Economy any time soon. The surge everyone saw over the last few decades was going from undeveloped to developed. It is not repeatable. China is broke from trying to bail out their own economy.

https://www.npr.org/2024/01/30/1227554424/evergrande-china-real-estate-economy-property-collapse

btt

“The structure of an office building is unsuitable for conversion to apartments. There is not enough water or sewer facilities, and the ventilation systems are all wrong for subdividing into smaller cells controlled by more thermostats.”

That’s total bullshit. Tell that to the people who worked there and spent up to 60 hours a week in those buildings. If workers can be there that many hours a week, then so can the so called “homeless” or “illegals”.

China’s building an expressway and bridge across the Darién Gap and already has thousands of Peoples Liberation Army troops coming in every month. Once the have imported a few million Chinese citizens they will put all the commercial real estate to good use.

Most of the loans are based on $ amounts before the big spike in inflation. Since we are on the way to $120,000 loaves of bread, those loans are going to be easy to pay off, even at 20% occupancy. /mostly joking.

> The problem is that 250K is a lot less than one day’s working cash for most medium size companies.

Then it behooves them to put some effort into choosing which banks they use to do business.

That is the problem.

If all medium size and large corporations put all their money in the very largest and most secure banks then the medium size banks will need to be bailed out....

As I said—it is a mess.

My bet as well.

I’m guessing your degree is not in commercial/residential hi-rise buildings. The building mains, the utilities & HVAC distribution requirements are in no way similar.

Thank you, Mr Obvious.

I should think that stockholders who own REITs (Real Estate Investment Trusts) will take a bath, if they haven’t already.

BFL

Long term, a lot of cities are going to empty out. Remote work is much more economically efficient.

Think of all the savings in fuel, and other expenses.

Here’ an idea. Maybe some of us should become “squatters” in Trump Tower??!!

Unsuitable for conversion to apartments Americans want to live in, true.

Conversion to taxpayer-funded dormitories for illegals, complete with communal bathrooms and no need to cook government-provided food? All of those class B office buildings will work just fine - and government subsidies will keep the CRE market afloat until they can figure out some new scam to trick investors.

I think it ebbs and flows. People are holding real estate in their portfolio. In a few years it will be advantageous to sell the property. Then it will come back around to people holding it again.

“Happens how many times a century?

Taxpayers getting the shaft?”

Happens every April 15. The filth.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.