Posted on 03/25/2024 1:35:01 PM PDT by Heartlander

In case you’ve still got money in a bank, Bloomberg is warning that defaults in commercial real estate loans could “topple” hundreds of US banks.

Leaving taxpayers on the hook for trillions in losses.

The note, by Senior Editor James Crombie, walks us through the festering hellscape that is commercial real estate.

To set the mood, a new study predicts that nearly half of downtown Pittsburgh office space could be vacant in 4 years. Major cities like San Francisco are already sporting zombie-apocalypse downtowns, with abandoned office buildings baking in the sun.

So what happened?

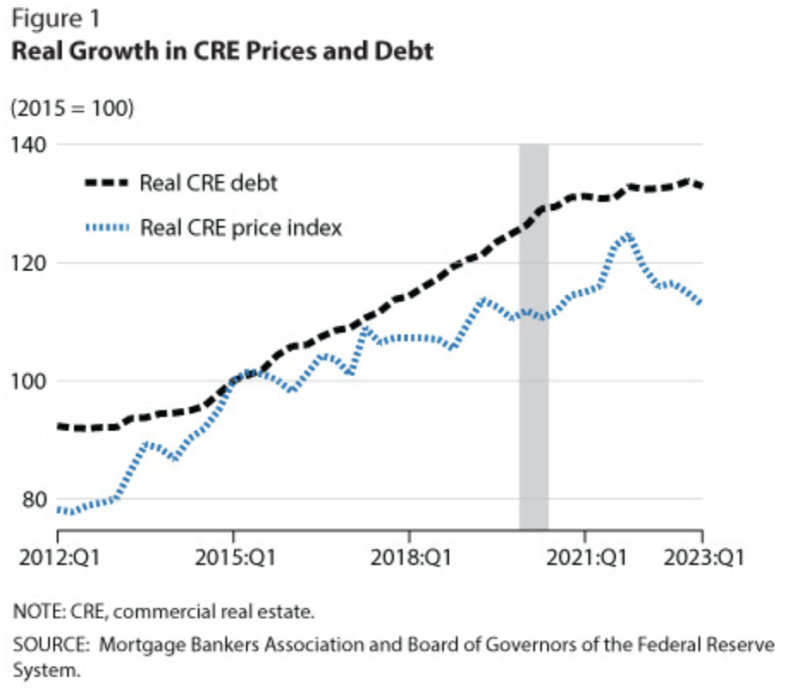

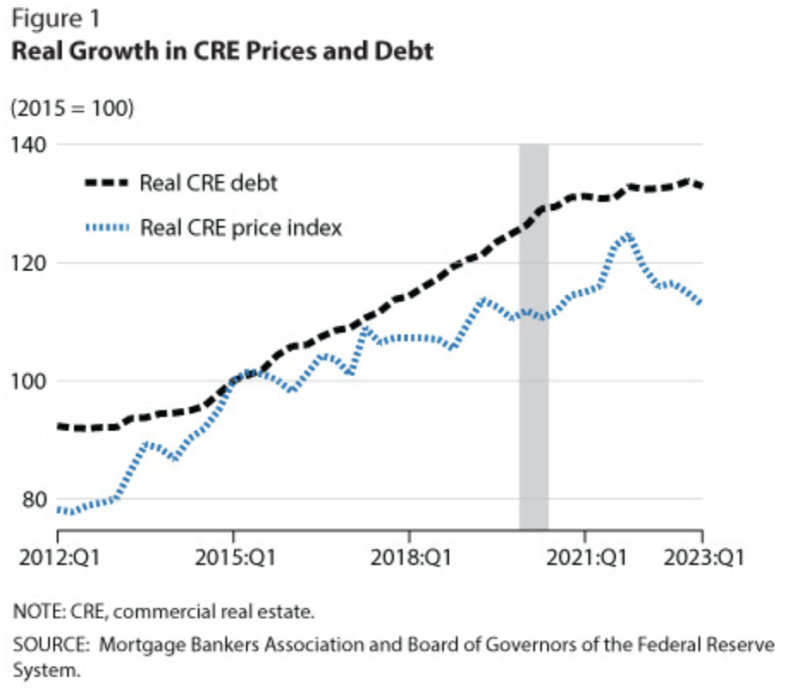

The Fed’s yo-yo interest rates first flooded real estate with low rates and cheap money. Which were overbuilt.

Then came the lockdowns, which forced millions to figure out new workday patterns. People liked foregoing the long commute (not to mention the free money). Despite every effort, downtown businesses have not been able to get all workers back.

These days, everyone talks about hybrid models of working, some in-person and some remote. But judging from observation, remote is winning. In any case, even a 30 percent reduction in the footprint of office space once the leases are renewed could topple the entire sector.

The restaurant and retail sectors of downtown feel the pinch, with more closures all the time. Adding to the pressure are absurd levels of inflation and ever-riskier streets on matters of personal security. Put it all together and there is ever less reason to slog to the office.

When the Fed panic-hiked interest rates in the 2021 inflation, that put trillions of commercial real estate underwater even without other factors. Add to that crime, inflation, plus remote work, and you have a dangerous mix that could toppled cities as we know them.

This could mimic and elaborate upon last year’s bank crisis, where falling bond prices panicked depositors. That crisis only stopped when Treasury Secretary Janet Yellen and Fed Chairman Jerome Powell effectively bailed out every bank in America with sweetheart loans written on fictitious asset values along with unlimited taxpayer guarantees through the comically underfunded FDIC.

By the way, the FDIC is essentially guaranteeing over $20 trillion in deposits on just over $100 billion. So they’ve got a half-penny on the dollar.

Without those government pre-bailouts, one paper last year by researchers at Stanford and Columbia estimated that 1,619 US banks – about a third of them – could be at risk of failure.

The problem is that nothing was actually fixed. In fact, it’s getting worse. For the simple reason that as the months roll by there’s more and more debt coming due.

And that brings us to Crombie, who notes that there’s $929 billion of commercial real estate debt coming due in the next 9 and a half months.

That’s up 28% from last year, and it’s getting bigger every day as banks pretend loans are still healthy by effectively adding missed payments.

We’re starting to see glitches in the matrix; New York Community Bank just went through a near-death experience over its garbage portfolio of commercial real estate loans, dropping almost 80% before it was bailed out by vulture investors while the megabanks hover like megavultures.

More will come. Potentially a lot more: a recent study from the National Bureau of Economic Research estimated that up to 385 American banks could fail over commercial real estate loans alone.

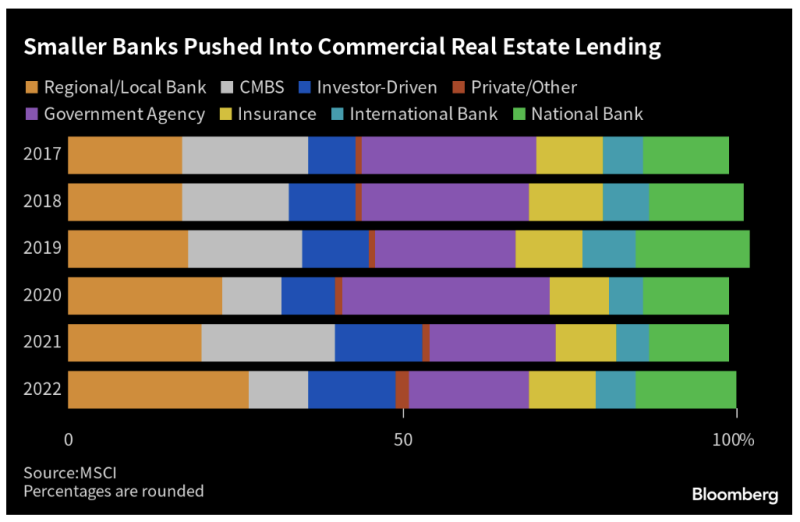

These would overwhelmingly be small regional banks, who typically hold a third of their assets in commercial real estate loans.

They hold so much because they know their local markets best, but the Fed poisoned that chalice by flooding easy money to developers.

For now we’re only seeing the sickest banks dropping out of the herd. That could dramatically accelerate as that $1 trillion plus in loans come due.

Commercial real estate delinquency rates have already jumped to 6 and a half percent – up 30% in a matter of months. Rates of distress in office loans just hit 11%.

When the smoke clears, we could lose dozens, even hundreds, of regional banks. Going by the last time with savings and loans, taxpayers ate 80% of the losses.

Meaning you could be on the hook for trillions, while the megabanks gorge on the carcass.

Slashing interest rates could staunch the bleeding. But with inflation marching up every month – currently at 5 and a half percent annualized – that’s not going to happen.

Not sure how we recover from this.

That is what people who build office buildings and high-rise condos tell me.

I trust their experience and opinion more than yours.

Their explanation is that water and sewer facilities in an office building are laid out in a central core with very few branches to the restrooms and break rooms. In a condo, the lines have a much denser branch structure that needs to reach each apartment with a much higher maximum capacity on each branch.

During the commercial breaks of the Super Bowl, you might have 2/3 of the residents scoot off to the can and then flush all at about the same instant. The peak load from apartments can be way higher than anything you could find in an office building during a lunch break.

Gotta plan for these things, you know.

HVAC systems have analogous problems with centralized chillers/heaters and ventilation. The zones in an office are way too big for apartment spaces and the vents are too few to work in apartment spaces.

You want the thermostat that controls your apartment to be located three units down the hall? I thought thermostat arguments in a common office space were nasty.

All this stuff can be changed. That change is expensive and amounts to gutting the whole building and replacing everything in it. Maybe one such project will be commissioned in one city as a virtue signaling effort to the rest of the nation.

The opportunities for graft and bribes ought to be spectacular. But I would bet that the project will run late, over budget, and will never be fully completed. And there won't be another one. We will have too many other problems more important than caring what is happening to bankrupt commercial property owners or where the illegals are living.

Sounds like a prison. Better add a substantial budget for riot control. Might need some confinement rooms too. About 80 percent of the illegal migrants are single military-aged men. Many are experienced criminals who have been turned out of their home country prison systems by their governments. They won't be easy to control in large numbers in confined spaces.

Cheaper to just build concentration camps (err... "resettlement centers") somewhere out on the plains. And that may very well be what we end up doing.

The property owners are going to lose their shirts. The regional banks that hold mortgages will likewise fall. The larger megabanks have enough clout to get generous federal program loans or grants and will buy up the vacant properties at pennies on the dollar. Some properties will literally change hands for one dollar.

There are a lot of possibilities when you can acquire large tracts of land for one dollar. Who cares what building was on it.

Your comment about "figure out a new scam to trick investors" is right on the mark.

I find the responders to this post to be much too kind.

In addition to the many and varied problems, nearly insoluble problems, mentioned in the article we probably ought to take a look at the Detroit example.

Demographic shifts, governance shifts, industrial base migration and extinction, loss of reputation as a “good place to live for families”. All this piles up on a region and on the economies and banks of a region.

Don’t invest in banks doing real estate business in the stressed major cities: L.A, San Francisco, New York, Chicago. Chicago looks like it is circling the drain already.

Working on an office conversion project right now, and the points you raise are all correct. You basically have to strip out all of the Office HVAC and Plumbing, and come up with a new layout for risers that work for the apartment layouts. The facade will probably need work as well. It’s almost impossible to lease or sell a residential unit without at least one operable window.

The real reason that there aren’t more conversions though doesn’t have to do with the ducts and the pipes and the electrical service, or even the exterior wall. It’s the basic geometry of the building. It’s easy to see once you know what to look for. In office buildings, the core to glass distance can be 35-40 feet. A resi unit wants to be about half of that, because no one wants a long, dark series of rooms and then one room with a big window on one side. No one would live there willingly, let alone rent or buy it.

Long story short, converting any meaningful amount of the downtown office inventory to commercial is not going to work, ever.

Commercial buildings may not be suitable for conversion to residential property, but will that stop the government from spending thin air money on such projects?

No, it will not.

What will stop such projects is a conspicuous failure of the first one, followed by pressing demands for higher priority activities with better and safer grifting opportunities for the sponsors.

The other factor is that we are starting to see major violent criminal activities from immigrant gangs which will personally threaten our current rulers and their families. They are about to discover that they cannot control the illegal immigrants they have worked so hard to bring into this country as compliant replacements for the native population.

The "newcomers" are not all going to be compliant slaves.

For a young single man who is an illegal immigrant, membership in an organized criminal gang pays a whole lot better than waiting around for a welfare deposit on an EBT card. And with perhaps ten million young men (16-45) in this category, a certain percentage will take up with the gangs. The absolute number will be quite large.

It won't matter as long as these men confine their predations to working class or middle-class natives. But the burglaries and home invasions are already starting to hit the upscale gated communities. As this continues, it will change a great number of priorities for the politicians. The rulers who buy and sell the politicians will see to that.

What will stop office-to-residential conversion projects is a decision by our rulers to spend that money instead on high-end security measures for the gated communities in which they live. They will also spend money to move the illegals "somewhere else". Like that small town where you thought you could move to escape the problems of the big city.

After all, what good is a multi-million dollar grifting deal from a conversion project if the sponsors can get killed in a home invasion from an immigrant criminal gang. Especially when the project is filled with gang members taking a cut from the deal who want a bigger cut than sponsors want to pay.

Maybe they can start another big war far away and draft the illegals to go away and fight in it. They can promise them "a pathway to citizenship". Whatever the rulers do to protect themselves will be too expensive and too important to waste available funds on virtue signaling projects like an office-to-residential conversion.

There just won't be very many of them for a combination of reasons, the least of which is that they are impractical.

The Feds will soon fill them up with our newly arrived replacements.

Why can’t they buy their own insurance?

Buying insurance for cash flow to support your operations kind of defeats the purpose. The money moves very quickly between accounts, so the insurance would probably be difficult to underwrite among multiple parties.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.