Posted on 06/12/2022 10:34:00 AM PDT by blam

There was a (very) brief period in which BofA’s Michael Hartnett – whom we long ago dubbed Wall Street’s biggest bear – turned ever slightly more bullish, when he told clients that while the bear market is far from over (recall he expects that to end some time in October with the S&P plunging down to 3,000) a powerful bear market rally had taken hold around the time we saw the biggest equity inflow in 10 weeks; even so, his advice to clients was simple: “fade all rallies.”

All that’s over, and in his latest Flow Show note (available to ZH pro subscribers), Hartnett asks “Where’s my bear market rally gone” and for good reason: both credit and stocks are massively oversold, BofA’s Bull & Bear Indicator is in deep “contrarian bullish” territory – falling to 0.3 from 0.4, more deeply in “extreme bearish” territory, and just shy off all time lows – and yet, despite this latest buy signal for risk assets having been triggered almost one month ago on May 18th, the S&P has gone from 3800 to 4200 and now back again to 3900.

But before we answer Hartnett’s rhetorical question, a quick look back two years ago to June 8, 2020, when as Hartnett notes, NYC announced stage 1 “reopening” after 13-week COVID lockdown, permitting curbside pickup from retail outlets. As the BofA strategist puts it, “if you had said then that two years later US retail sales would be up 67%, unemployment would fall by 17 million, inflation would surge from 0.1% to 8.3%, oil would soar from $12/b to $120/b, that a pandemic would be followed by war & famine, you would have been thought utterly mad; but that’s what happened.”

For those looking for catchy Wall Street soundbites, here is from Hartnett: “2020 marked a secular low in inflation & yields, the beginning of regime change and a decade of social, political, economic & financial volatility.”

And speaking of regime change, there have been few clearer examples of that then the “inflation shock” we have now:

◾natural gas 141%

◾gasoline 91%

◾oil 61%

◾iron ore 45%

◾wheat 39%

◾nickel 39%

◾soybean 33%

◾corn 30%

◾cotton 30% YTD

And with the triple whammy of COVID, monetary & fiscal stimulus, and war, we have seen “massive 18-month outperformance of inflation assets” but watch for low in biotech (deflation) vs real estate for a trend reversal, according to the BofA strategist.

Which is not to say that everyone is fighting a war with inflation: there is always Japan, the perpetual outlier. According to Hartnett, the BoJ is the last central bank left fighting the last deflation war (i.e., the “Shoichi Yokoi” trade), which has sent the yen plunging 14% YTD as Kuroda repeatedly vows unlimited bond buying to defend YCC policy which in the past 6 years has led to… wait… 0.0% Japan GDP growth & 0.2% CPI. That dismal math then leads us to another even scarier equality from Hartnett, one which has anything but a happy ending:

investor “policy incredulity” = yen collapse = (Asia FX war) = BoJ FX intervention = capital repatriation to Japan = potential catalyst for summer global risk-off trade.

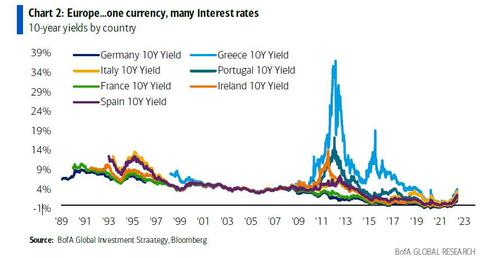

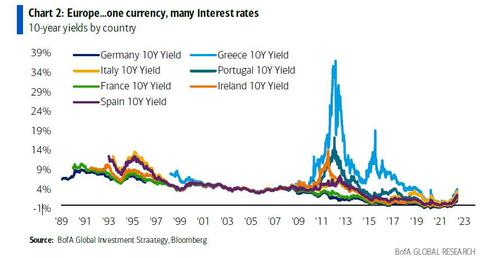

Meanwhile, turning attention to Europe, we find one currency but with many interest rates:

As we noted earlier this week, with EU CPI at 8.1% and PPI at 37.2%…

… the ECB boldly decided to…not raise rates, leaving policy rate at -0.5%, and to continue QE until July 1st. Yet despite the ECB’s failure to “wake up” and “go-go”, Greece 10-year yields exploded above 4%, and Italy 5-year yields shot to fresh 8 years highs, above 3% and blowing away the March 2020 highs as BTP-Bund spreads soar wider than 200bps.

Meanwhile, as we also said earlier today…

10Y Italian BTPs close up 16bps at 3.763%, highest since 2014.

Either the ECB is about to fire Berlusoni again or Europe is on the verge of another sovereign debt crisis. In any case, this little rate hike experiment won’t last long pic.twitter.com/4qYnH7ofiX

— zerohedge (@zerohedge) June 10, 2022

… and as Hartnett echoed “markets stop panicking when policy makers start panicking”… but the reason why there is still no bid for risk assets is that “there is not enough inflation panic yet, policy credibility waning, higher risk premium required.”

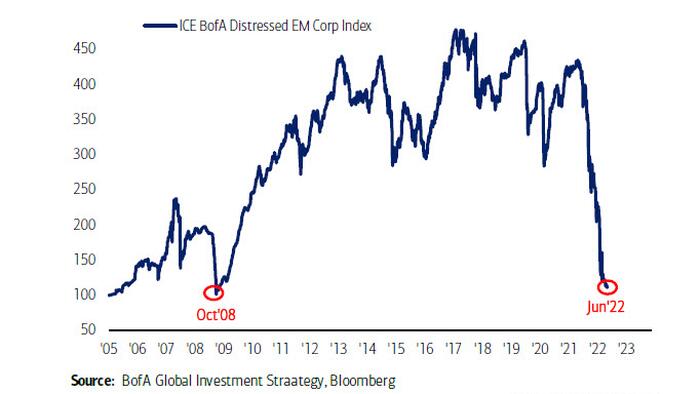

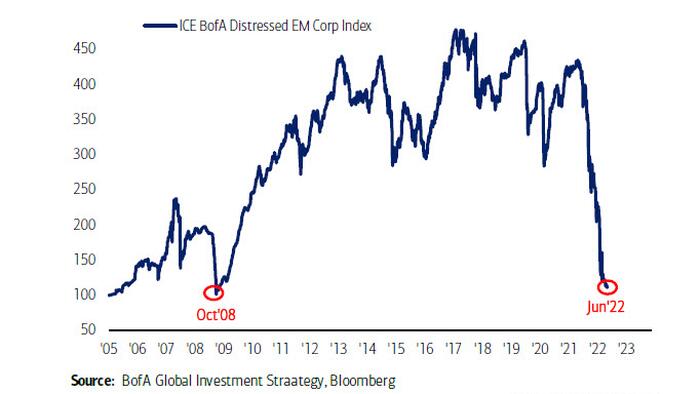

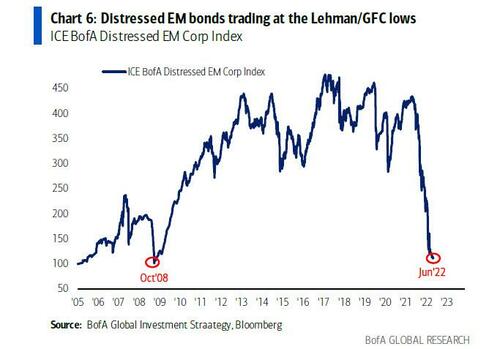

One final observation on the Bear Market: one third, or 33% (952 of 2910 stocks) of the MSCI All World ACWI index currently trades below their 2018 highs, 40% of Nasdaq (1496 of 3760 stocks) trading below their 2018 highs; and some more staggering math: global equity market cap peak to trough down $23.4tn since Nov’21 = 1 US economy (US GDP $24.4tn); meanwhile, in a sign that things are indeed about to snap, distressed EM bonds trading at the Lehman/GFC lows of 2008, almost as if EMs are competing with Europe who blows up first.

Which brings us back to answering the key question posed by Hartnett: “Where my Bear Market Rally gone”, and why despite massively oversold conditions and record revulsion, are stocks unable to bounce? His answer: ◾In short, inflation shock not over, rates shock just starting, growth shock coming, no release valve from peak in yields, bear market ralliy too consensus.

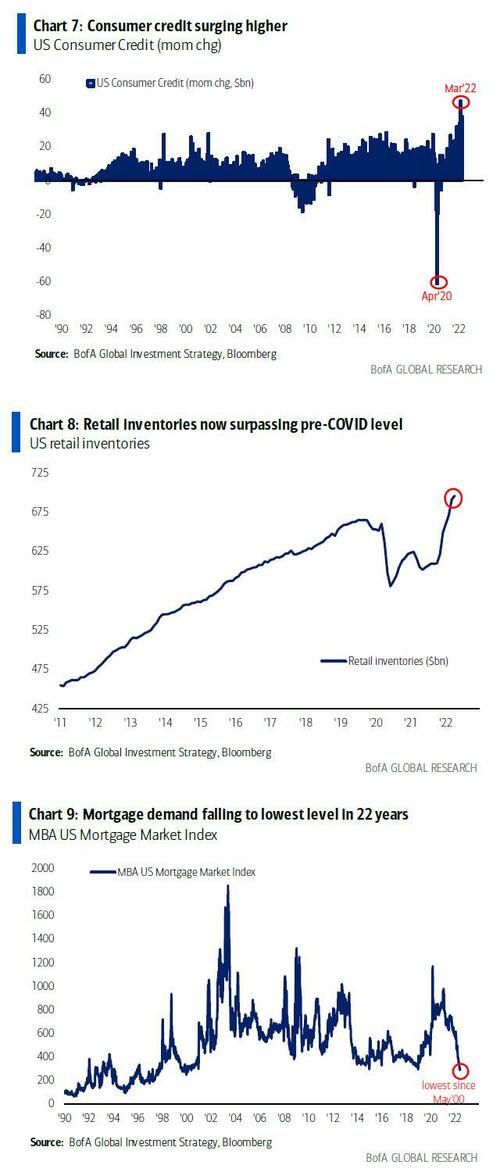

◾Inflation: geopolitics, end of globalization, extraordinarily misguided G7 energy policies across the G7 = 2 standard deviation commodity shock unlike any other since 1973/74. ◾Recession: we’re in technical recession but just don’t realize it; US Q1 GDP -1.5%, Atlanta Fed GDPNow forecast for Q2 just 0.9%, a couple of bad data points away from “recession”; consumer data getting murkier.

◾Household and consumer balance sheets point to shallow recession, what can turn shallow into deep is the great unknown of the shadow banking system.

◾Stagflation: Hartnett says growth is returning to trend, but inflation won’t as stagflation is incompatible with “goldilocks” SPX PE of 20x past 20 years, and should be closer to 20th century PE of 15x.

◾Events: the occasions (all of which saw BofA Bull & Bear Indicator at 0) when very bearish sentiment not enough to turn markets were 2 standard deviation events caused “liquidations”: WorldCom Jul’02, Lehman Sep’08, US debt downgrade Aug’11, China devaluation Aug’15

; ◾Nagging worries that QT just beginning: to expose fragilities in EM, crypto, tech, VC/PE, risk parity, CTAs.

As a result of the above, Hartnett is convinced that no matter how strong the intervening bear market rallies – whether it is a benign CPI print (clearly not todays’) or something else, and narrative flips back to peak inflation – his ultimate bear market targets remain 30Y TSY at 4% and SPX at 3600 (markets always overshoot/undershoot, and we assume no systemic crisis).

And with the market on its way to said lows, the BofA strategist warns that the most vulnerable assets to own are Big Tech (positioning, secular loser), REITs (inflation hedge), resources (they are in secular bull but at lows investors forced to sell winners), and US dollar (will discount peak yields).

Finally, once we finally do hit the lows, these are the assets that will be bought: long-duration Treasuries (for obvious deflationary reasons), HY bonds (where risk deployed first)…

… EM bonds & stocks (distressed, weak dollar beneficiaries), small cap (the surprise bull coming), industrials (according to Hartnett the next policy stimulus will be fiscal not monetary, but we disagree: after November, the US will have a Dem President and Republican Congress, and the two sides will not reach a bipartisan agreement on a stimulus, leaving only the Fed) and of course the widely lamented 60-40 strategy: all these will be the most likely winners at end of bear market, some time in late 2022.

I ALWAYS listen to the advice coming from Big Banks. You see, they have absolutely nothing to gain from me making a trade. I trust them absolutely.

All of it deliberate by the billionaire globalist psychopaths of the World Economic Forum, may their private jets fall from the sky.

If only it were just a commercial...

We’re up the creek...and we all know the name of that creek....let the good times roll!

Absolutely NO HITS for "ICE BofA Distressed EM Corp Index".

Absolutely NO HITS for "Distressed EM Corp Index".

Regards,

Thank you! I looked for that as a gif but couldn’t find it!

So...someone went to a lot of trouble to deceive you but you caught them. Is that what’s going on here?

No, not to deceive me personally!

But someone went to a lot of trouble to create an image purporting to present useful and actionable information - yet I can find no trace of it on the Internet.

The source is also somewhat suspicious:

BofA Global Investment Straategy, Bloomberg

Strange, isn't it?

Regards,

So...what is the purpose.

Who benefits?

“All the information provided on this website is provided on an “as is” and “as available” basis and you agree that you use such information entirely at your own risk.

"The ZubuBrothers gives no warranty and accepts no responsibility or liability for the accuracy or the completeness of the information and materials contained in this website.

"Under no circumstances will the ZubuBrothers be held responsible or liable in any way for any claims, damages, losses, expenses, costs or liabilities whatsoever (including, without limitation, any direct or indirect damages for loss of profits, business interruption or loss of information) resulting or arising directly or indirectly from your use of or inability to use this website or any websites linked to it, or from your reliance on the information and material on this website, even if the ZubuBrothers has been advised of the possibility of such damages in advance.""

They essentially reposted ZeroHedge materials, not noticing that some of the graphs' labels included misspellings. They look for donations, but withhold their whereabouts and their "whois" search shows thrid-party shileding of even their location. They use a WordPress structure, and so seem quite like just another small potatoes operator pretending to be a news service.

"Bank of America's Hartnett Sees ‘Pain and Exit’ If S&P 500 Dips Below 4,000"

Source: https://www.bloomberg.com/news/articles/2022-04-29/bofa-s-hartnett-sees-pain-and-exit-if-s-p-500-dips-below-4-000

S&P closed last Friday at $3,900.86. It began the year at almost $4,800, so the drop is significant.

But watching the effects of the Biden administration's utter incompetence in monetary policy and Congress' continual spending like the proverbial drunken sailor, "pain and exit" was a foregone conclusion. Both Yellen and Lagarde have said the West has printed too much fiat money. Reality sets in. Expected....

...but in 2019 the S&P stood mid year at about $2,900, and so the hysteria seems a little like these last two and a half years of the bogus pandemic in which only 99.9 percent of the worldwide population did not die. We swim in a morass of media deception all around these days. being cautious and skeptical is warranted. Best regards.

I myself prefer to trust my financial advisor; but, that is just me.

With the search strings in quotes, DuckDuckGo returns plenty of hits but I’m not sure what you think the significance of that is in either case. Lots of sites exclude themselves from GoogleBot searches.

Intercontinental Exchange Bank of America Distressed Emerging Markets Corporate Index

-PJ

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.