Skip to comments.

Yuan Surges Most In 15 Years On Expectations Of Pro-China Pivot By “President Biden”

Latest Today News ^

| 10/09/2020

| Tyler Durden

Posted on 10/09/2020 7:57:47 AM PDT by SeekAndFind

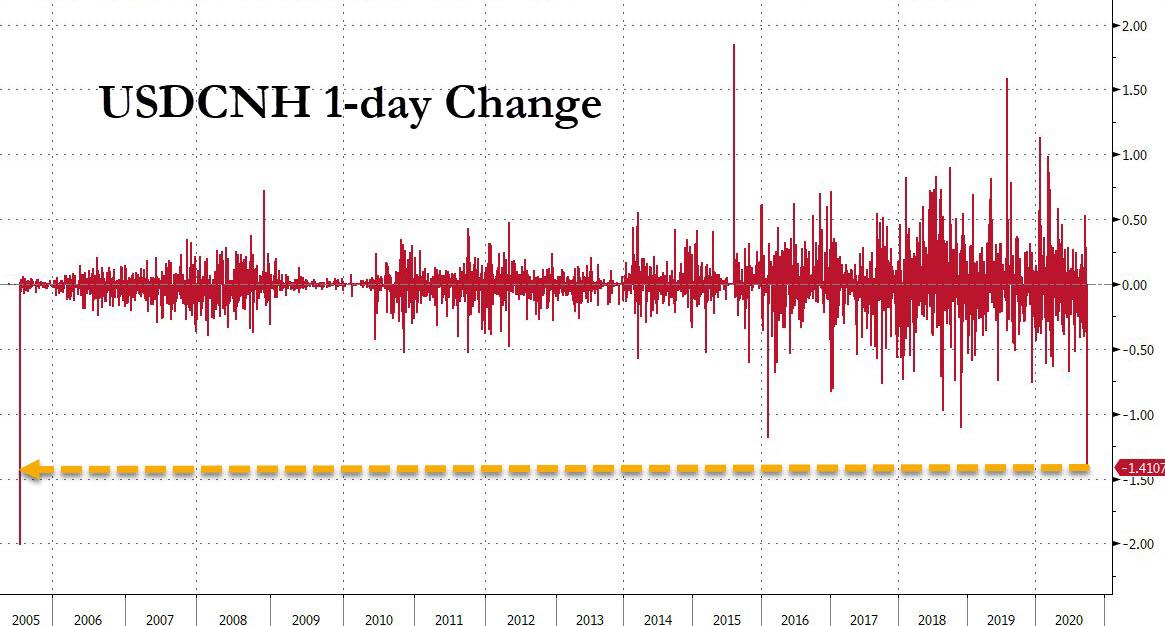

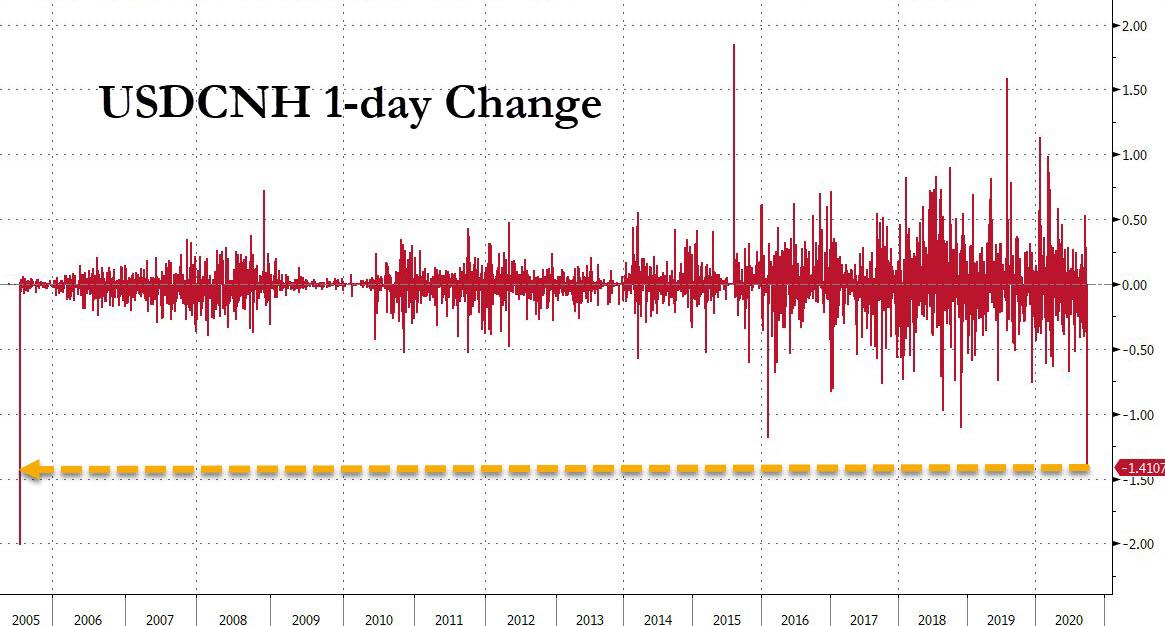

China's onshore yuan, which was closed for trading during China's week-long Golden Week holiday, soared 1.4% today as China returned to work and as the onshore yuan (CNY) caught up to the recent surge in the offshore yuan (CNH), driven by the recent plunge in the dollar and the rising expectations that Joe Biden will win the presidency and renormalize US-China relations by pivoting to a pro-China stance.

The onshore rate for the yuan, which had not traded since September 30 due to holiday, soared as much as 1.41% on Friday to 6.6950, the strongest since April 2019.

That was the biggest one-day change in the CNY since July 2005, when China broke the yuan-peg to the dollar and revalued its currency.

The more-loosely regulated offshore renminbi, which traded throughout the holiday, climbed 0.8% to 6.6818 against the dollar.

What prompted the surge? According to strategist cited by the FT, traders in China on Friday were emboldened by the imminent possibility of a US administration that was more friendly towards Beijing.

According to Daniel Been, head of FX strategy at ANZ, the increasing probability of a win for Democratic candidate Joe Biden in next month’s US presidential election had helped to lift the Chinese currency: "The view in the market is that the way a Biden administration approaches [US-China relations] is probably going to be less confrontational and certainly using trade less as a tool or weapon against China."

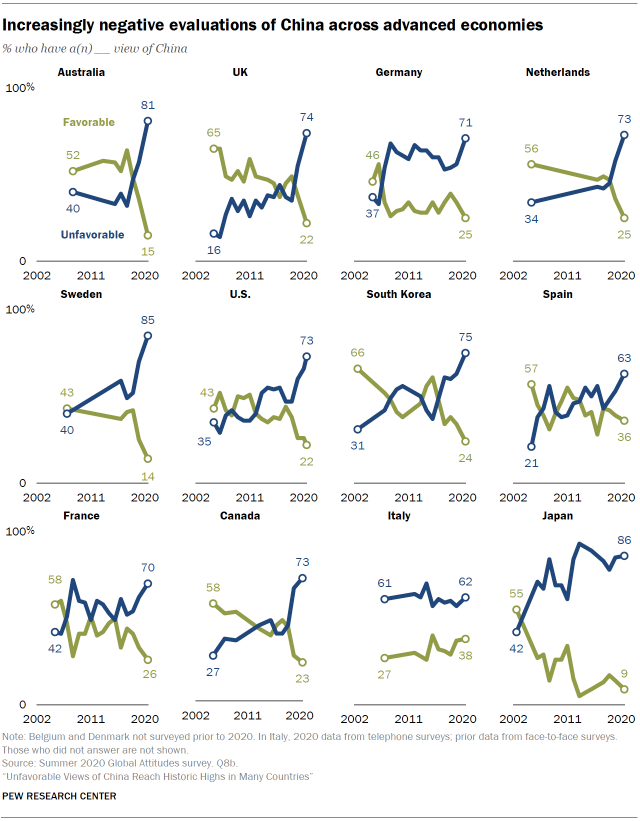

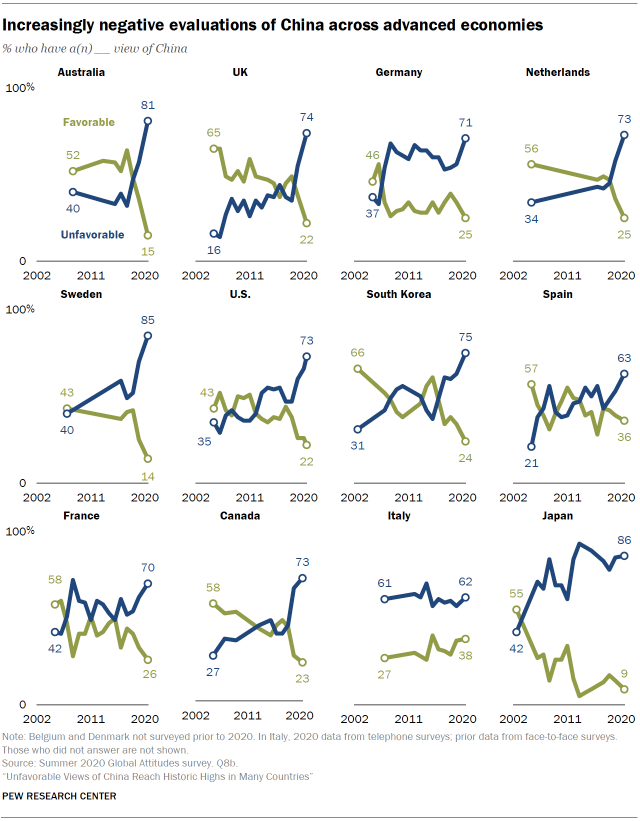

In short, China views Biden a distinctly pro-China president, which is concerning at a time when anti-China sentiment across virtually the entire world has reached record levels, as Pew found this week.

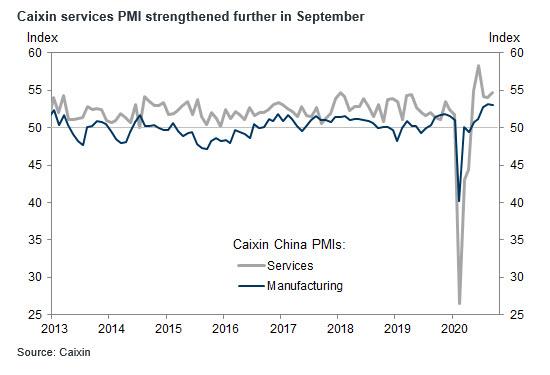

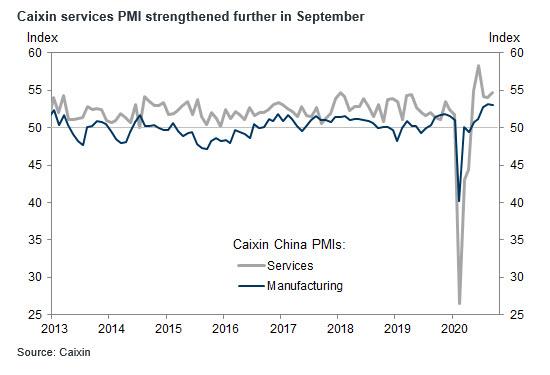

In addition to sentiment about Biden's pro-China agenda, the Chinese currency was also boosted by fresh signs the economy is improving after authorities controlled Covid-19 in the country. Overnight, the Caixin China Service PMI showed activity climbed to its highest level in three months in September.

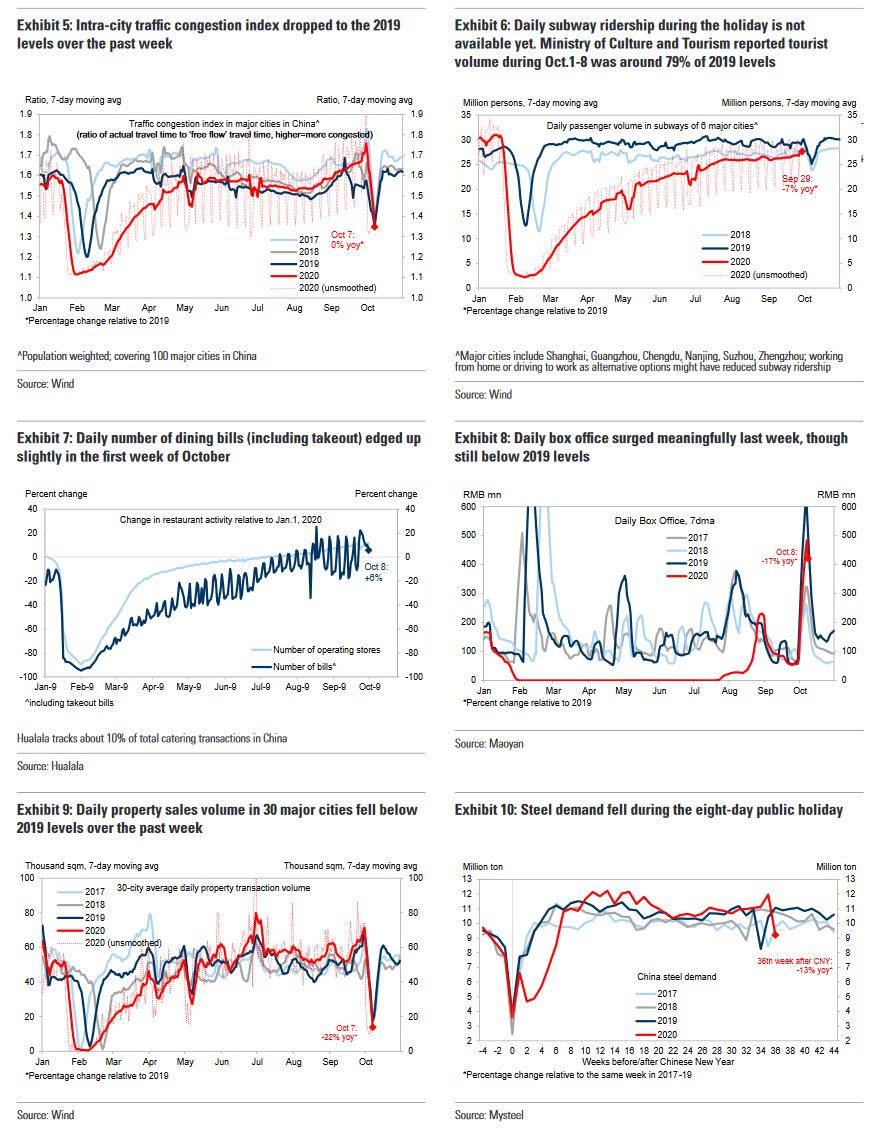

At the same time, Macquarie China economist Larry Hu, pointed to rising retail sales and a “significant” 17% year-on-year jump in domestic passenger traffic at Shanghai’s airport during the long holiday. "It’s clear that consumption, especially service consumption, is on the mend."

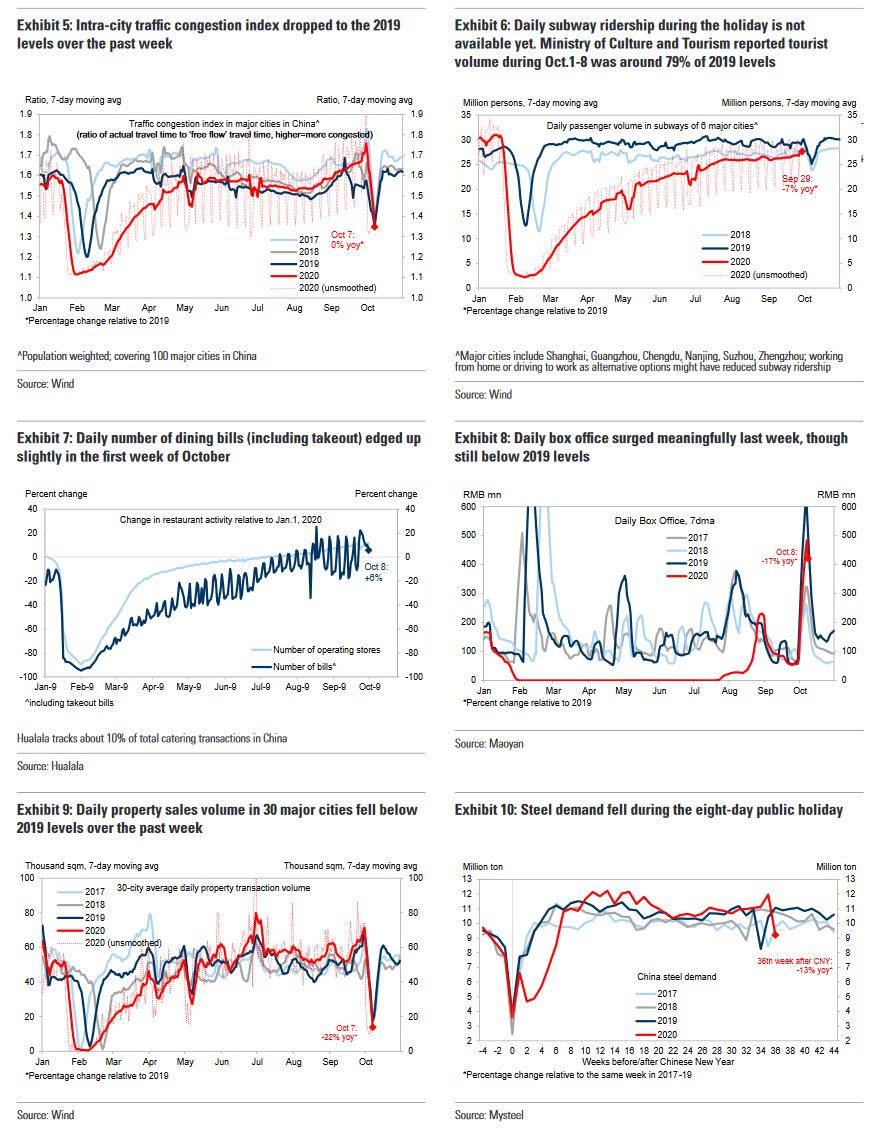

Nomura analyst said that while overall passenger trips on public transportation were down about 30% y/y in the first few days of the holiday, transport ministry data showed that average highway traffic volume fell only 5.5%. A snapshot of China's high frequency economic indicators from Goldman showed continued economic mending.

China’s improving economy stands in contrast to the US, where activity appears to be slowing, and is set to slow further amid continued Congressional gridlock over a new fiscal stimulus package.

Quoted by the FT, Christy Tan, head of Asia markets strategy and research at National Australia Bank, said there was also growing confidence that Chinese authorities would not intervene to stymie the renminbi’s rally.

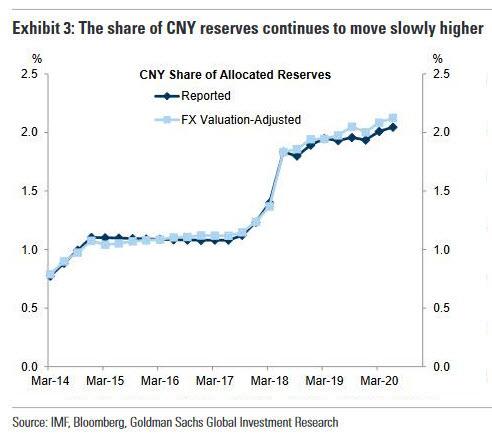

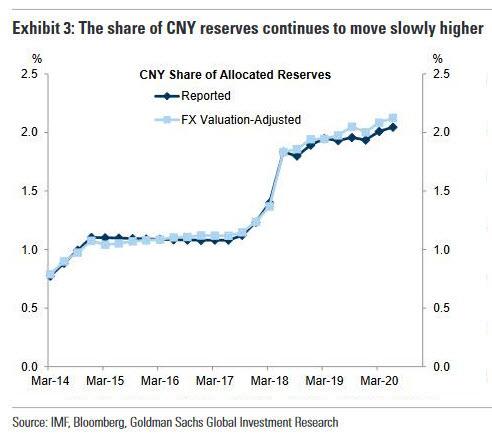

"The prospect of renminbi appreciation is getting more structural — it’s no longer just cyclical," Ms Tan said, pointing to greater trading offshore and inflows from global investors into China’s markets. "There’s a sense of confidence that the renminbi is getting more internationalised." To be sure, the latest IMF data confirmed a record allocation toward CNY by reserve managers.

The surge in the yuan was reflected in broad asset optimism, with China's benchmark CSI 300 index closing 2% higher after onshore markets opened for the first time in six trading days. The tech-focused ChiNext index rose 3.8%.

As the FT notes, flows into China’s onshore equities market have topped Rmb90bn ($13.4bn) this year, taking foreign holdings to more than Rmb1tn on the back of the country’s relatively strong economic recovery. "We expect foreign capital inflows and foreign holdings in the A-share market to continue to rise,” said Bruce Pang, head of macro and strategy research at investment bank China Renaissance, referring to the country’s onshore stock market.

TOPICS: Business/Economy; Society

KEYWORDS: biden; china; currency; yuan

To: SeekAndFind

Counting their chickens before they hatch.....

2

posted on

10/09/2020 8:01:02 AM PDT

by

Bobalu

("You can't serve papers on a rat, Baby Sister. You gotta kill him or let him be." --Rooster Cogburn)

To: SeekAndFind

Biden/Harris: Make China Great Again

3

posted on

10/09/2020 8:02:39 AM PDT

by

rightwingintelligentsia

(Democrats: The perfect party for the helpless and stupid, and those who would rule over them.)

To: SeekAndFind

4

posted on

10/09/2020 8:06:20 AM PDT

by

BenLurkin

(The above is not a statement of fact. It is either opinion or satire. Or both.)

To: SeekAndFind

link cannot connect

seems to time out but ends trying to connect without specifically saying the attempt timed out

why interest in connecting?

Who owns “latest-today-news.com”?

5

posted on

10/09/2020 8:06:29 AM PDT

by

Wuli

To: rightwingintelligentsia

Followed by “Line my Pockets Again.”

6

posted on

10/09/2020 8:06:50 AM PDT

by

Army Air Corps

(Four Fried Chickens and a Coke)

To: SeekAndFind

And yet, despite the enthusiasm and high expectations the Chinese Communists have that somehow the Harris/Biden ticket will prevail, there are huge clouds over that otherwise rosy forecast.

What if, in the event of strange machinations in the electoral process here in the US, a clear winner cannot be determined in the Electoral College, because of a number of inconclusive state vote tallies, and the election is thrown on the House of Representatives?

Nobody has a lock yet.

7

posted on

10/09/2020 8:07:44 AM PDT

by

alloysteel

("The Best Is Yet to Come "- theme of 2020 RNC)

To: SeekAndFind

Hmmm...at this point in election...I thought this was Babylon Bee

8

posted on

10/09/2020 8:08:38 AM PDT

by

goodnesswins

(The issue is never the issue. The issue is always the revolution." -- Saul Alinksy)

To: SeekAndFind

“ renormalize relations”

We will become permanent thralls of Chinese mercantilism. And the Chinese world order, with a nuclear Iran to balance their goals.

No one will ever do what Trump is trying to do.

9

posted on

10/09/2020 8:10:36 AM PDT

by

silverleaf

(A live Biden speech is like a solar eclipse: rare, and leaves everyone in the dark)

To: Bobalu

Covid didn’t kill Trump so maybe they caught wind of another arrow being launched at him by Pelosi

To: alloysteel

There’s a deadline for the EC (dec 18th I think). Constitution says President is elected by majority of EC votes cast. So if a state with say 20 EVs doesn’t certify before the deadline, then only 518 EVs are cast and 260 wins it. That’s the way it’s supposed to work. But we all no some corrupt judge will issue some lame injunction he pulls out of his a$$

11

posted on

10/09/2020 8:14:24 AM PDT

by

wny

To: SeekAndFind

Sentiment about China matters little. What matters is money.

To: alloysteel

BINGO!

The goal is not a peaceful transition.

13

posted on

10/09/2020 8:25:09 AM PDT

by

null and void

(Surely there must be someone on FR who makes bricks! Contact me if that's you!)

To: doc maverick

"Good morning. Sunday morning"

14

posted on

10/09/2020 8:28:36 AM PDT

by

null and void

(Surely there must be someone on FR who makes bricks! Contact me if that's you!)

To: SeekAndFind

The Yuan probably went up because gold is going up. It is going up because the US will pump stimulus into the system again. The Yuan went up because China is way ahead of the rest of the world in the development of a digital currency.

The Chinese yuan does not revolve around the US Election.

To: Bobalu

I am writing this post as I am trading currencies. That is what I do for a living. I don't trade USD/CNH because it is highly manipulated by big banks or it goes through periods where there is little price movement. Most forex pairs with the USD are manipulated, but at least with the majors/crosses (EUR, GBP, CHF, CAD, AUD, NZD) the manipulation by big banks is survivable and even profitable if you know what you are doing.

Understand the following about forex: 1.) There is no true supply and demand as there is in equities. 2.) These are fiat currencies that are not backed with an underlying tangible asset (i.e., if you trade WTI futures, there's actually oil underlying the futures). 3.) In forex, big banks drive price when and where they want. 4.) News, economics, elections and world events mean little to big banks in the short-term other than opportunity to make money. These events establish client sentiment - that is small investor's and trader's positions. Once those positions are in place, big banks go stop hunting and take out the little guys and then the banks drive price in the opposite direction.

Moral of the story - the current price of USD/CNH means nothing, just as the current price of any forex pair. You need to look at the long-term (months) to extract anything fundamental about the market.

16

posted on

10/09/2020 8:51:25 AM PDT

by

ConservativeInPA

("War is peace. Freedom is slavery. Ignorance is strength." - George Orwell, 1984)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson