L

Posted on 09/21/2011 11:57:26 AM PDT by NormsRevenge

WASHINGTON (Reuters) - The Federal Reserve on Wednesday dialed up its aid to the beleaguered U.S. economy, launching an effort to put more downward pressure on long-term interest rates over time and help the battered housing sector.

The Fed said it would launch a new $400 billion program that will tilt its $2.85 trillion balance sheet more heavily to longer-term securities by selling shorter-term notes and using those funds to purchase longer-dated Treasuries.

It will now also reinvest proceeds from maturing mortgage and agency bonds back into the mortgage market, an acknowledgement of just how weak conditions in the sector have remained.

"Recent indicators point to continuing weakness in overall labor market conditions, and the unemployment rate remains elevated," Fed said in its statement.

Faced with a lofty 9.1 percent jobless rate, consumer and business confidence sapped by a troubling U.S. credit downgrade, and an escalating sovereign debt crisis in Europe, Fed officials have signaled they would seek to prevent already sluggish U.S. growth from weakening further.

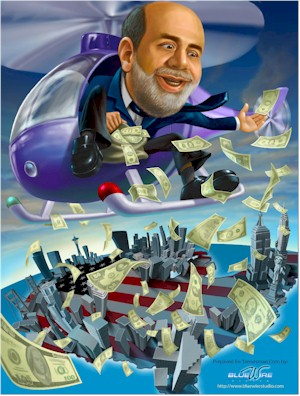

But even as Fed Chairman Ben Bernanke has indicated the central bank's reluctance to stay on the sidelines, Fed activism has become a punching bag for politicians as an election year nears. Top Republican congressional leaders wrote to Fed Chairman Ben Bernanke this week urging the central bank to desist from further economic interventions, echoing criticism voiced by Republican presidential candidates in recent weeks.

Fed officials, however, believe that by shifting their bond holdings they could encourage mortgage refinancing and push investors into riskier assets, such as corporate bonds and stocks, without stoking a run-up in consumer prices.

(Excerpt) Read more at news.yahoo.com ...

Does this really hlp? & where is the 4 billion coming from? Will they print it and call the paper—money.

Sounds like a classic ponzi scheme.

Tax payer paid mortgages to buyers that can't pay the loan installments. Is this what they call a stimulus?

How much is going into the non-existant “shovel-ready” jobs this time?

Sounds to me like they’re just moving one pile of existing money into another pile.

So long as they don’t flood the economy with new dollars, I’m fine with this. I don’t think it will do much other than prop up the markets, though.

JMHO, somebody on Wall Street is sure not impressed.

About the time that announcement got made, the Dow took a hundred point dump, and it’s just kinda wobbling around now.

Guess it does take some time for the guys from the Fed to load up the wheelbarrows and get to the exchange after all.

Wonder how much THIS “rally” is going to cost my grandkids.

L

QE3 ping!

Greenspan taught Bernanke that printing money can cure any problem.

...because another quarter point off mortgage rates will make all those 99’ers jump into the housing market and buy buy BUY!

The Fed is only shifting the maturity dates of their balance sheet. They’ve run out of ammo.

This is not a $400 billion stimulus at all. It will simply transfer $400 from short-term US Treasury bills to long-term US Treasury bonds.

This move will do nothing to fix the economy, and the stock market will reflect this moving forward.

They don't have to print it. All they need to do is to say it exists and it exists. It just appears in the balance sheets. It is nothing more than photons on a monitor.

The market doesn't seem impressed...

does anyone remember voting on this?

Imagine if he didnt do this..

How about Obama running on :

" Elect me because the economy is so bad, I have 4 years direct experience working with bad economies ....Hope and Change redux with edited scenes put back in...This time I will raise taxes to jumpstart the economy..."

?

Dow down 199 points now.

Markets took a dive at the end of today’s trading session. Down 231.

See: QE I, QE II, QE III, ad nauseum.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.