Posted on 02/26/2012 4:42:54 PM PST by blam

Is Crude Oil About To Crash The Markets?

Commodities / Crude Oil

Feb 26, 2012 - 02:08 PM

By: WavePatternTraders

Do I or Don't I?

I decided not to bother, what you ask? writing more of the same about the US stock markets, It don't need a genius to write that the US stock markets are in a coma and stuck in the ICU room waiting to come back into the real world. Although nothing has really changed from the current ideas I am reluctant to post more of the same stuff when nothing really has happened.

I can write some interesting articles when the markets actually move. So I personally would rather write about something that might be of interest to readers.

Oil

How will oil, or should I say how can oil crash the markets? And I might add the economy.

I started looking into this idea a few days back and it sort of clicked as to why oil has rallied back in sync with stocks again.

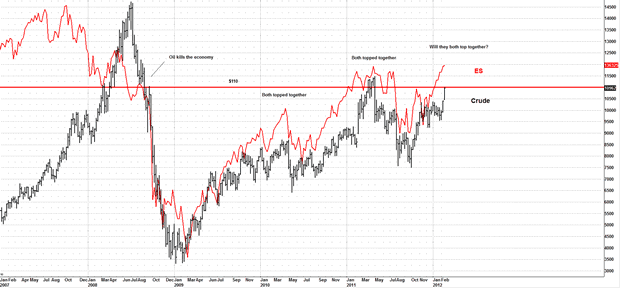

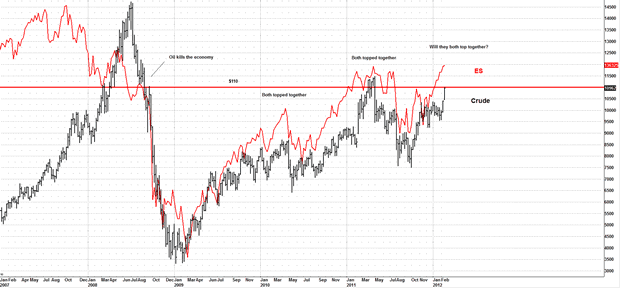

There appears to be a point with oil, that when price pushes back about that area things start to crumble, I think it's the $100-110 area.

I don't think the world can support oil at $100-110, much less the US economy.

If you look at the chart, you will see the 2 times it did that, it had a dramatic effect on stocks, suffice to say the markets are trying for a 3rd time.

I actually think we are setting up for something like Jul 2008 or May 2011, oil at these levels is bad news when you see it above $110 it has a bad affect on stocks. As shown on the 2 previous occasions it's been above $110.

As oil is an integral part of everyday life, the knock on affect is alarming, in that less money is being spent in the economy as its being taken by higher fuel costs.

People from using their cars to go to work, will spend less on groceries and luxuries and even daily transport of food and goods will increase, so as the price of oil goes up so does food and consumer goods, which again places importance on the price of oil as it kills the economy.

You saw that back in Jul 2008 and May 2011 and I suspect we are setting up for the very same thing again.

What was it that Einstein said? Insanity: Doing the same thing over and over again and expecting different results.

Simply put the world can't sustain oil at above $100-110 as it takes $$$ away from the GDP as the cost of everyday items goes up. I am not an economist I don't possess one of the spangling shining certificates from Yale or Harvard, but I live in the real world where I use fuel for driving.

If you pay more on fuel costs you spend less on other items, that is just simple basic maths.

Especially fuel and everyday items we buy, oil has a big knock on affect in the economy.

Look at what happened when oil started pushing above $100 for the 1st time around Dec 2007-Mar 2008, stocks started pushing lower.

Now look what happened at the May 2011 highs.

Coincidence? I don't think so.

Will history repeat? Is this time any different? Can the US economy really sustain oil above $110 and see the markets continue higher?

History says no.

I know one thing, oil going to the moon isn't positive for stocks, the 2 previous times it's been above $110 area the markets crashed.

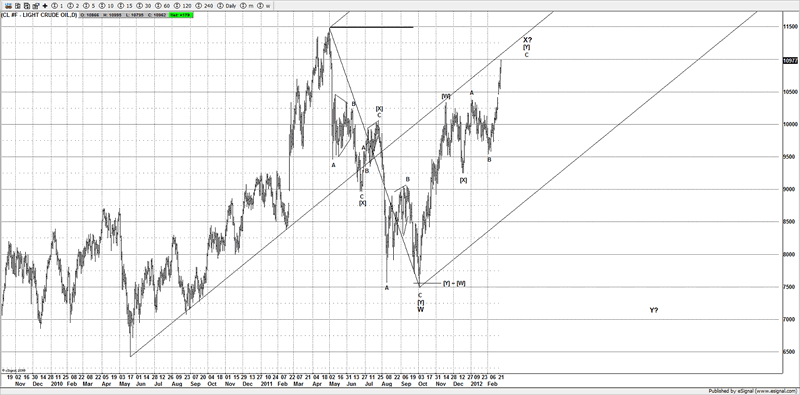

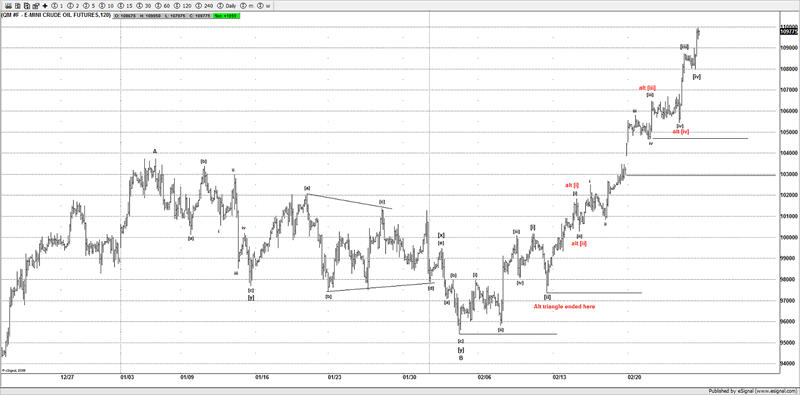

If working an X wave on this current advance, then it should near to its conclusion as the recent moves count well as an impulsive move.

Although you can label it as a triangle, but the ideas are still the same and potentially finding a high with stocks and probably the metals gold, silver etc and even alignment with EUR/USD into the 136 area.

There are enough gyrations to suggest this is completed, although I will give the benefit to the trend above $106, as we could pullback in a 4th wave i.e. wave [iv] and push towards $112-115 area.

A strong break lower is a caution, it reminds me of the moves into the last high at $115 last May. What a trade that turned out to be, we were all over that and made some terrific gains.

A great trade is coming for oil. Suffice to say, oil could be one of those trades of the year, where you can make a serious amount of $$.

If you recall back to the May 2011 highs, it was oil that broke 1st, then stocks and virtually everything else followed, even gold and silver finally puked, when in a liquation type event, things get sold good or bad as margin calls are called in and $$ needs to be found.

With potentially 5 wave advances from the Dec 2011 lows in gold and silver, to finish potentially bearish ideas, with oil into areas where it puts serious pressure on stocks and the US economy, I am not sure this can continue much longer.

There are many pieces of the puzzle appearing to converge and align.

I now think oil is probably the most important chart that traders need to follow going forward and its one I am going to be glued going into next week.

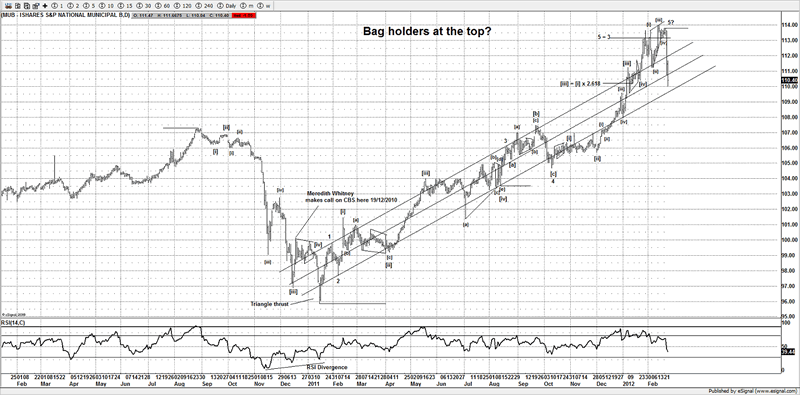

MUB

I wrote about municipal bonds a few weeks back, and potentially it's now cracking, that's a big loss if you bought the highs, 30 days worth of gains lost in 2 days!!!! Yes 2 Days!!

It shows you what happens when the boat is so far to one side. Is the Titanic starting to sink? What about Oct 2007? Stocks will never go down, but they did. It always goes up don't it??? It can never go down, or can it? Now think about that for a bit, remember back in May 2011, same thing there on US stocks, stocks are never going to go down.

But they did, fast forward to present day, stocks will never go down!

The rest is up to history to decide.

Apple going up forever as well, isn't it?? hmmm we will see about that, bag holders never really realize they just bought the highs till it finally hit their pain threshold.

If this crashes will they blame Meredith Whitney again? What excuse will they find?

Conclusion

I am seeing some alarming signals from other markets, the one that sticks out is oil, I am still working the same ideas on stocks and think we are setting up a for a large reversal, oil at these levels is not a healthy sign as seen above, the facts speak for themselves, and I don't argue with history.

Unless of course you believe stocks can power higher along with oil above $110 then I suggest a strong caution if traders are still long stocks and other risk assets.

Bump

I keep hearing how great the economy is by hitting 13,000. Nobody mentions though, that the dollar is worth about 40% less than it did 10 years ago. So 13,000 is actually 40% less than that.

...oil going to the moon isn't positive for stocks, the 2 previous times it's been above $110 area the markets crashed.Thanks blam.

“Never Let a Crisis Go to Waste”

Obama thinks he will have a reason to do whatever he wants by executive order.

I don’t know if it’s about to crash the markets or not, but it’s about to crash the economy.

For the last few years, there’s been no correlation that one could see between the markets and the economy any more. The rise of the crony capitalists is nearly complete I fear.

No one talks about how low the volume is when chatting up the 13K number.

The dow multiplier supposedly accounts for inflation but what is really different from years ago is that most of the companies in the dow 30 are different now, compared to then. Apples to oranges to compare dow across decades.

Yup.

Uncle Sam’s Fire Sale. Minimum Investment: $1 Billion (Crony Capitalism)

bump

Yes, the rising oil will cause the market and economy to dump. I don’t need charts, I’ve seen this before. It’s like Ground Hog Day with Bill Murray all over again.

I bought some oil stocks which are supposed to profit on the rise. When the market dumps, the price of oil wil drop down and we’ll all be in the Marianas Trench. I just need to pick the time to sell the oil stocks. I’m hoping to make enough money to pay the taxes on the gain and still have some left over to help pay my gasoline bill:(

Given the worldwide market vs the US market I am staying at high growth on large cap. It’s worked so far.

These were the big traders of oil futures. They were the ones pushing for $200 oil prior to that time.

There were several FR threads back (before 09/08) then on how large blocks of trades were made between brokers to establish higher oil.

There were at least two FReepers that said this was B.S. (traders), that seem to have disappeared after 09-2008.

With Lehman Brothers gone, oil fell to a reasonable 50-60/ bbl. Others have taken up the slack and now are the ones calling for 150 oil. *They learned not to push for 200 oil.

Does an Obama .... in the woods?

I originally posted this on May 28, AD 2009, which is the date of the GM bondholders being "MF Globaled". I'll be building on this tomorrow with regards to a path forward for the US dollar and the gold standard debate. Posted by

Ann Barnhardt - May 28, AD 2009 10:36 PM MST

I came across a FASCINATING historical tidbit today on the internet. Historians regard the year 1811 as the year that the United States matured from fledgling former colony into global industrial and moral power. Do you know why? In 1811 tensions were building between the U.S. and British. We were on the run‐up to the War of 1812. While this was going on, the First Bank of the United States, founded by Alexander Hamilton in 1791, was liquidated because its original 20‐year charter expired. Many of the bondholders of this bank were . . . British. There was enormous political pressure, given the hostility and tensions with the British, to give the British bondholders the shaft and pocket that money to help finance the coming war. The leaders of First Bank refused to go along with the desires of the politicians and repaid every penny of their debt, including their British creditors. Why did they do this? Because it was the LAW. The Rule of Law came first to these men.

This one act of integrity had a cascading effect that essentially set the course of this nation and its economy for the next 198 years. Word quickly spread throughout the business districts of Europe that the words "Backed By The Full Faith And Credit Of The United States Government" meant something, and meant something real. European investment dollars came pouring in to the "fledgling former colony", the industrial revolution was born, and The United States of America that we all know and love was born. We are literally the children of integrity, the children of "full faith".

That era ended earlier this week. Without the rule of law, the words "full faith and credit of the government of the United States" are meaningless words. And, just as money came flowing in 198 years ago, money will now go flowing out. Our government is now fascist and is run by gangsters who would not know integrity if they were being beaten over the head with it.

God help us.

http://barnhardt.biz/

But inflation is a bogus number since food and gas are not included in the calculation and those are the things that have doubled and tripled in price.

Roast in my area (even when not on sale, it never hit above $2.99 a lb) is $4.78 a lb.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.