Posted on 05/11/2014 6:59:26 PM PDT by blam

Why the Stock Market Could Rise 74% in the Next Three Years

May 11, 2014 GMT

By: Investment_U

Marc Lichtenfeld writes: We had a bit of a scare in the markets last month. At one point, the S&P 500 fell more than 4%, causing some permabears to proudly proclaim that the "bubble" had burst.

Of course, they're not quite so vocal now that the market has rebounded and is back within 1% of its all-time high.

As you know, we're not market timers at Investment U and The Oxford Club. But I believe this market has a long way to run before the bulls stop making money.

Market History

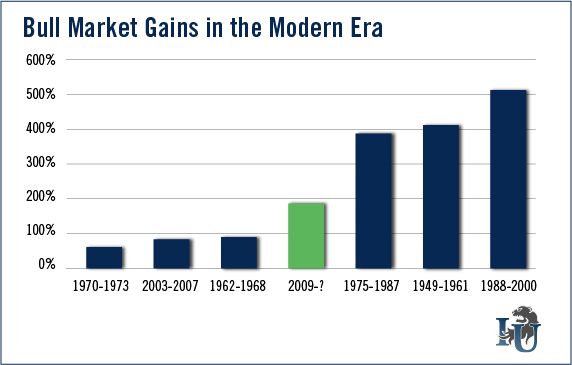

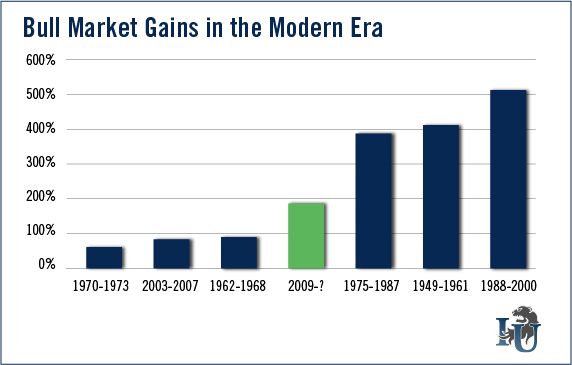

Although this bull market is getting mature, it is not ready for the rocking chair. The bull has now been around for 63 months. That's longer than nine of the 15 bull markets since 1871.

Surprisingly, though, it still has five more months to go until it is average in terms of length - and 41 months before it reaches the post-World War II average.

Bull markets have been getting longer since the end of the War - a lot longer. Starting with the bull that began in 1949, bull markets have lasted an average of 104 months - or nearly nine years. That five-year old bull doesn't sound quite so old now, does it? Of the seven bull markets (including the current one) since then, this one ranks only fifth in terms of length.

From the low in 2009 at 666.79, to the all-time high of 1,897.28, the S&P 500 has risen 185% - a heck of a move. That's above the 163% average since 1871. However, the modern bull market (since the end of WWII) has averaged 259% gains.

Interestingly, three bull markets gained less than 100% while the other three were up 391%, 414% and 516%, respectively. Could the fact that the current one broke through the 100% barrier mean that it's headed significantly higher?

If the market simply performed according to the average modern day bull market, it would last another 3 1/2 years and rise 74%.

(snip)

"The crisis is imminent," Schiff said. "I don't think Obama is going to finish his second term without the bottom dropping out. And stock market investors are oblivious to the problems."

‘Cause that is how much the Treasury is going debase our currency during that period?

Everyone here is on the same track - the rise of the stock market will coincide directly with the devastating depreciation hitting our currency. If this forecast we are going to have currency less stable than the Brasilian cruzeiro in short order.

The bottom line: Get out now! The suckers are being reeled in.

bfl

74%? A distinct possibility.

75%? Out of the question!! Are you mad?? That would be simply impossible!

“Why the Stock Market Could Rise 74% in the Next Three Years”

Oh that’s an easy one, inflation. I think the 74% is a little

low. Might be closer to 400 maybe 500%. The only reason

it isn’t going down now is that inflation is keeping it

propped up. There is no real gains in the stock market

especially with 0.01% national growth. It’s all adjustments

for inflation.

"Brother, can you spare a dime" will become "Brother, can you spare a hundred dollars"

I guess we’re headed for a crash!

Why Monkeys Could Fly Out of My Butt.

Every year we send more and more American money to China.

Last year we imported 440 million worth of Chinese goods.

Last year we exported only 122 worth, to China.

China continues to ever grow. America continues to go further into debt.

China can invest in America. Americans cannot truly invest in China - they must get a majority local owner.

Americans cannot buy land in China. Chinese can buy land in America.

We are selling off our own nation. Right now. The only reason prices are going up, is that we are selling off America to foreigners.

Bring back American manufacturing.

Sorry correction:

That is 440 billion imported to America last year, to 122 billion exported to China.

Bring back US manufacturing.

And a Mercury dime will be worth at least a hundred dollars.

Yes, I believe it will be worth that..or even more.

They call old silver quarters, half-dollars and dimes “Junk Silver” It is sold in bags and is a wonderful way to add precious metals to your SHTF store.

Much better to have old US silver coins than bar silver as it will be easier to barter with small amounts of silver. How do you trade large bars of silver for a fish dinner?

Gold is less desirable than silver because in a disaster situation gold will either become illegal, and thus confiscated, or they will add a huge tax for gold transactions.

Much more upside to come...

Gold is NOT a safe haven. It will fall. Bookmark this and see if what I have said is true.

“Everyone here is on the same track - the rise of the stock market will coincide directly with the devastating depreciation hitting our currency.”

It is worse than that; nothing drives stock prices up as much as the news of layoffs of American workers. If the stock market rises 74% over the next three years, our official unemployment rate will be 60%. During the Clinton years our overlords convinced the American people that the rising stock market was an indication of a strong American economy that benefited all Americans (even as we started to offshore an increasing amount of white-collar work); the last half dozen years have shown that was a lie.

I seem to remember that whenever articles like this start appearing, the market crashes not long after.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.