Posted on 12/01/2017 11:04:04 PM PST by usar91B

Taxes cut for all.

“nobody promised you a rose garden. “

I beg your pardon!

This is the best that Donald J. Trump can do with the clowns in Congress.

We need a better tax and spending policy than this but I say its not Trump’s fault as much as its the GOP’s.

God Bless President Trump and God .... the Republicans in the House and Senate.

Good to hear the bill was passed.

After the 2018 mid-term we won’t have Corker and Flake to whine their way into the news and if the MAGA candidates work hard we won’t have this razor thin majority any longer. I am hoping we can pick-up a half-dozen or more of the 23 Democratic seats in the mid-term??

Mz Collins will miss all the attention but let’s roll MAGA !!!

I have a positive view of cutting corporate tax rates, so long as those cuts are offset by some kind of re-investment incentive in manufacturing within the United States. In other words, it does no good to cut corporate taxes if the end result is solely to make corporations richer, while they still offshore all the skilled jobs (or continue to employ increasing amounts of H1B1 visa workers). If there’s no reason to repatriate wealth to the US, what’s the point? In fact, I’d even be willing to pay more, if I knew I could earn a larger salary as a result of growth. I do think Trump gets that equation. He might be rich but he, at least, reputedly pays well for good reason. It keeps people happy, and reduces costly turnover and loss of skilled labor. We’ll see. Congress is not looking out for anyone, so I hope Trump does.

Corker, only R nay.

Collins put in an amendment to partially keep the SALT deduction, finally did something right.

From FReeper dangus:

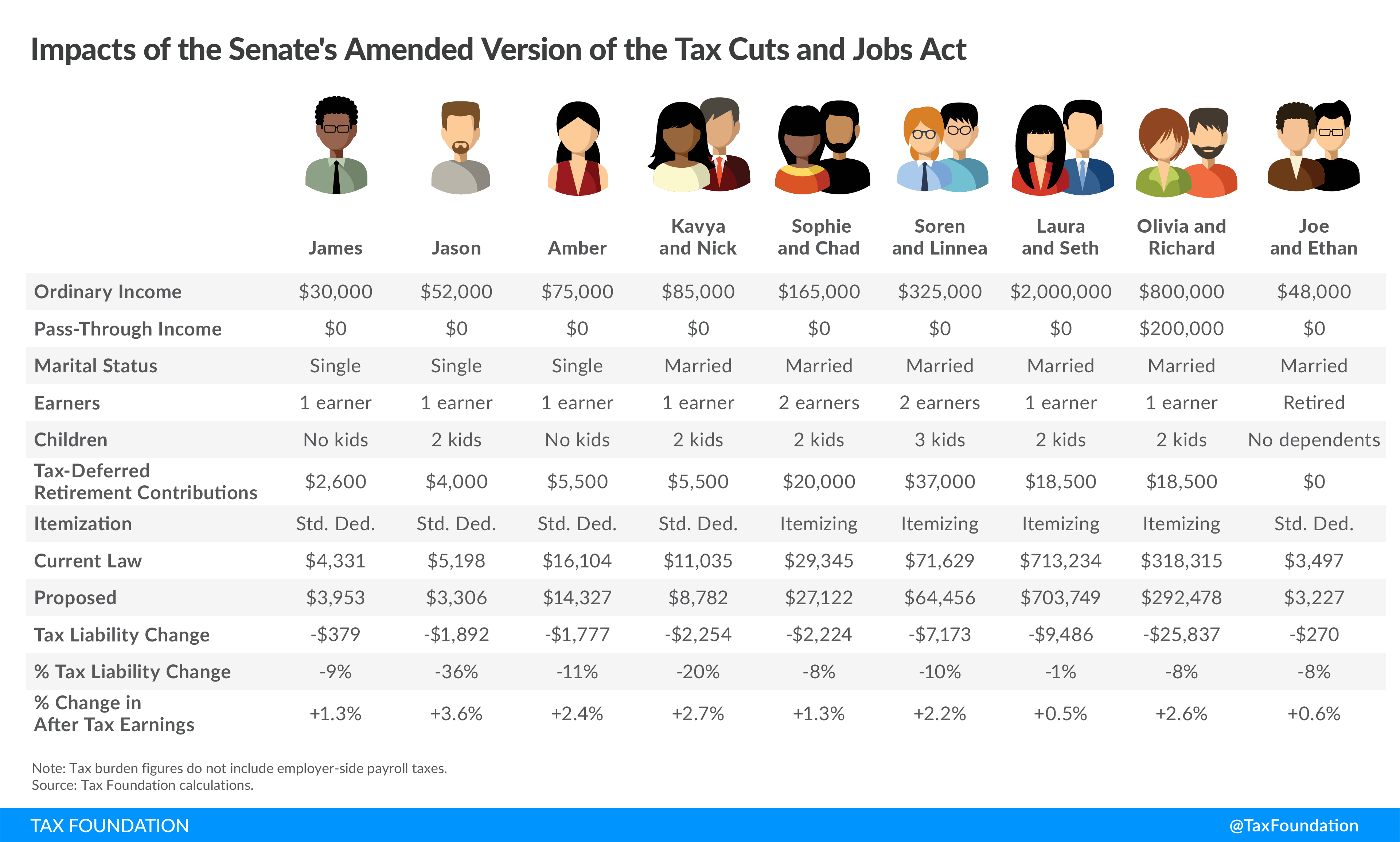

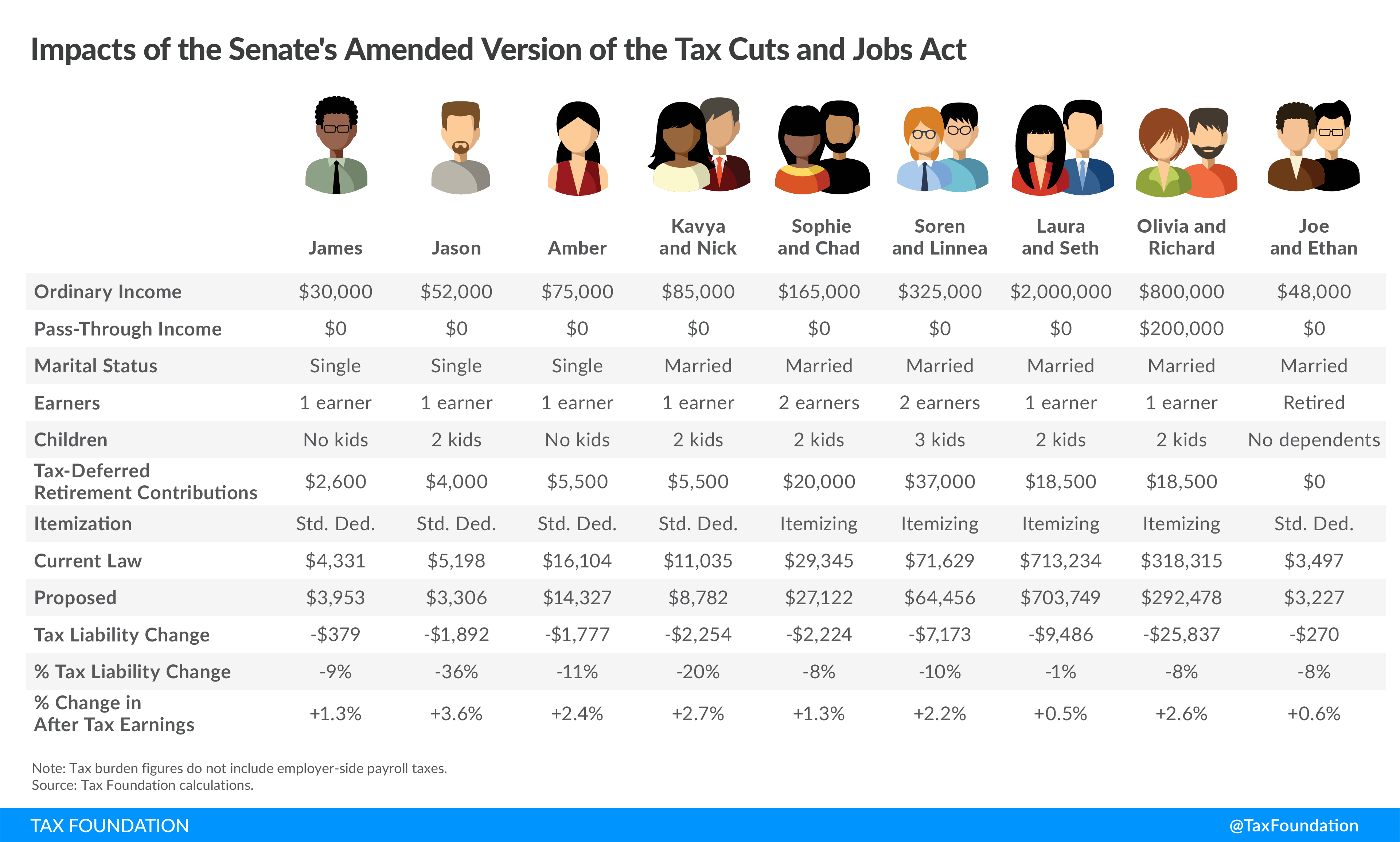

The major effects on the taxation of wages and salaries for a married couple with two kids are these:

TAX BRACKET CUTS: 15% tax bracket lowered to 12%. 25% tax bracket lowered to 22% up to 1$40,000. 28% tax bracket lowered to 24%.

STANDARD DEDUCTIONS: Almost doubled from $12,700 to $24,000

PERSONAL EXEMPTIONS: eliminated.

CHILD TAX CREDITS: Increased from $1,000 per child to $2,000 per child, but the 2nd $1,000 is only given to the extent that taxes do not go negative. CNN repeats an outrageous lie that the elimination of the Standard Deduction means families with more than 2 kids can face tax hikes; that ignores the increased child credits.

EFFECT ON A FAMILY OF 4:

WORKING CLASS: making $50,000. After standard deduction income drops from $37,300 to $26,000, but taxable income (after exemptions) increases from $16,200 to $26,000. Taxes before credits increase from $2,237 to $2,749. But credits mean that the actual taxes after credits decline from $237 to zero. In fact, the family could make a lot more and still pay zero taxes; such families could save thousands.

MIDDLE CLASS: making $100,000. After standard deduction income drops from $87,300 to $76,000. The loss of exemptions raise taxable income from $71,100 to $76,000. Decreases in tax rates lower the base taxes from $9,737 to $8,749. With credits, this family saves about $3,000: Its taxes owed drop from $7,737 to $4,749.

TELL YOUR LIBERAL FRIENDS: These two groups get a sharper cut in taxes than the cut in the corporate-profits tax rate!

UPPER MIDDLE CLASS: making $250,000. After standard deduction income drops from $237,300 to $221,000. The loss of exemptions raise taxable income from $221,100 to $226,000. Decreases in tax rates lower the base taxes from $48,773 to $39,263. With credits, this family saves about $11,000: Its taxes owed drop from $46,773 to $35,263.

WHAT ABOUT IF CONGRESS FAILS TO PASS CONTINUATION OF TAX CUTS?

From what I can see, it looks like the the tax rates go up, but the credits aren’t repealed. This means the working class STILL pay zero taxes; the middle class keeps a little less than half of its tax cut, and the upper-middle class still gets a slight tax cut.

TELL YOUR LIBERAL FRIENDS: Even if individual taxes go back up, the working class STILL pays no taxes, the middle class STILL gets a (smaller) tax cut, and the tax-”cut” package results in MORE revenue after 2027, not less, than if the Senate fails to pass the tax cuts.

THERE ARE OTHER EFFECTS

I’m trying to write about on whom the burden of taxation falls to dispel the myth that the Senate tax plan is unfair to working Americans. I don’t get into the effect of the corporate tax cut, but taxes are cut on all working and middle-class families more than on corporations. (That’s not even mentioning that fact that lower taxes on corporations means more profit to pass on to stock-holders, which means more money collected in personal taxes.)

I also don’t get into various tax cuts not likely to effect individuals in any given year, such as the expansion of the inheritance tax exemption. But this is a tax cut the 1% will NOT be getting.

The loss of exemptions for state and local sales taxes will not thrill your liberal friends who dwell in liberal states. But those will effect the poor they claim to be so concerned with far less... except for a few examples where liberal states are totally screwing the poor (like Virginia).

The repeal of the individual healthcare mandate won’t affect many people, except small business owners and independent contractors.

LOL you really want to go there ;)

Cutting the corporate tax rate should persuade many corporations to stay within the US.

I save about $2000. But I'm paying nearly $20,000 in property taxes.

How will I be doing without any changes in "Resolution"?

“...all while adding more than $1 trillion to the deficit over the next decade...”

I’m guessing that is a projected number by the dems. When Bush II lowered the tax rate, tax revenue increased. Like you said - more incentive to stay in the U.S., so more money earned/created in the U.S., and more money taxed in the U.S.

There was some thread with some guy saying he voted yes for the tax rates as he was promised a yes vote for helping the “Dreamers” - I hope that isn’t true. There goes the increased revenues.

Yes. Make no mistake about it. This tax bill has Trump's fingerprints all over it.

When Bush II lowered the tax rate, tax revenue increased, but not nearly enough to keep up with the all the spending increases. There was so much potential, but they just spent and spent and spent some more. I expect that will happen this time, too.

$30.00 Donation Bump! On the way!

The big issue for grassroots working people is the availability of cheap labor in this country.

If the big corporate entities and their GOP lapdogs insist on cheap labor access to this country front door DACA or back door H1 visas, then we have a fight going.

Reminds me of the bullshit Obamacare charts.

Especially with “Joe and Ethan” in there.

Exactly, “Joe and Ethan”, what a bunch of despicable sneaking rats!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.