I’ll be able to retire when they carry my corpse away from my desk. I can easily see that that’s how it’s going to be.

I’m not worried. I will have Social Security...

I know I know. I couldn’t stop laughing either.

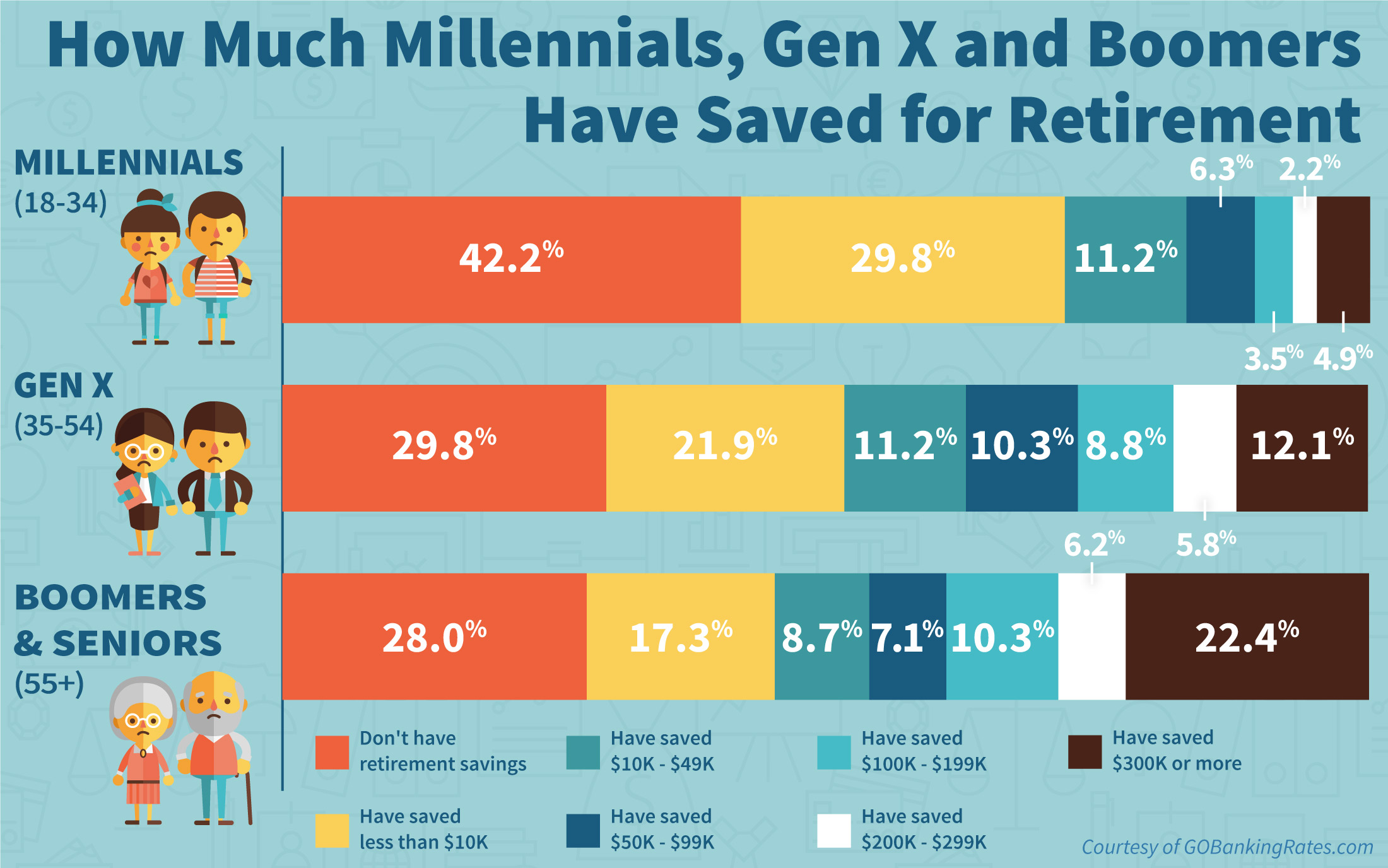

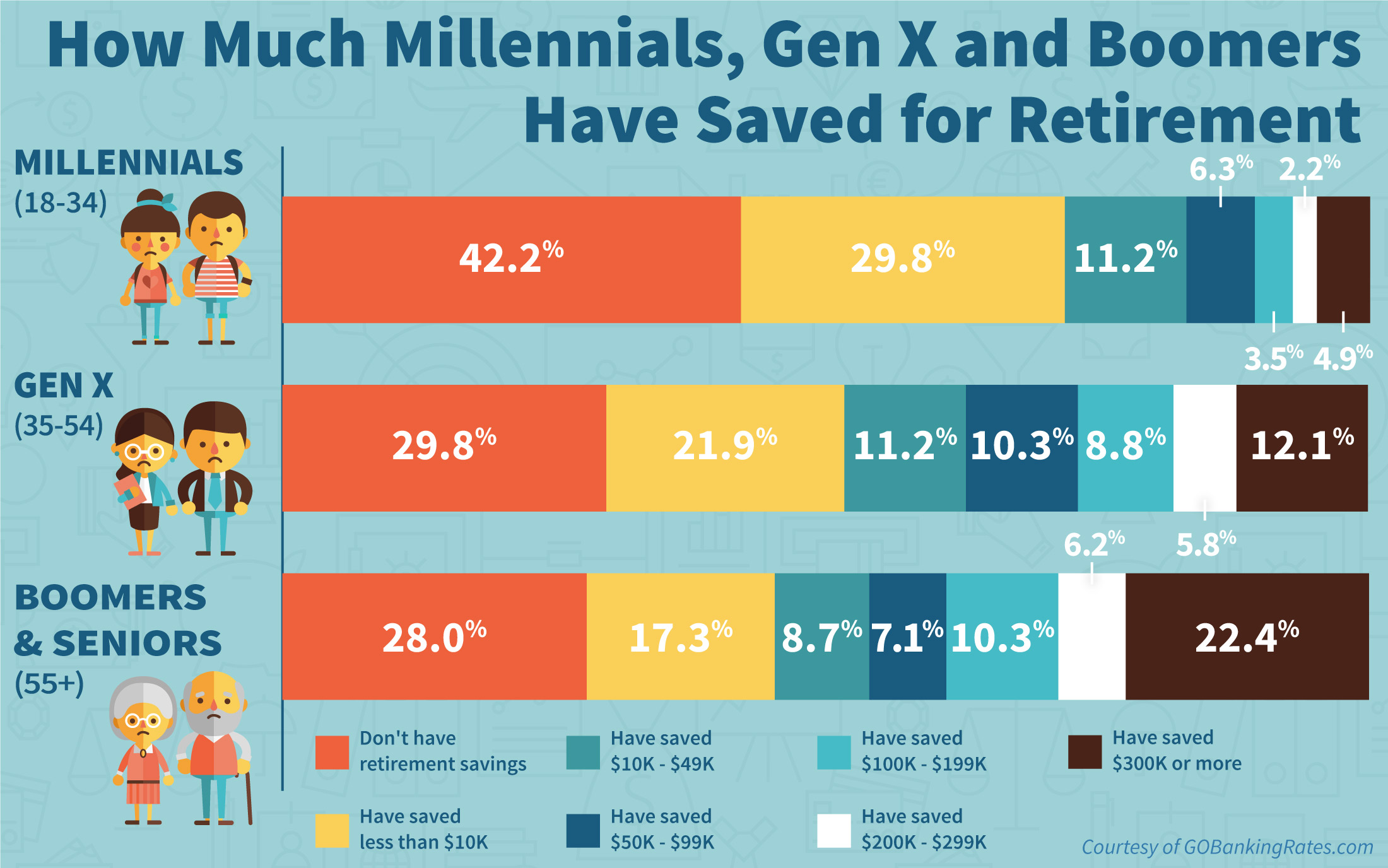

This chart is a progressives wet dream. All those greedy rich people with savings to tax on one side to give to the non-saver majority on the other side. Everyone must be equal. It’s not fair that others have more than anyone else.

But folks approaching age 60 now and everyone younger: The house was a piggy bank, constantly remortgaged or accruing new debt with second mortgages. Career-long jobs are rare, so very few families have had a chance to build up savings without debt. All of that is why these numbers are meaningless: What is the real amount of available wealth adding or subtracting for home equity and subtracting all debt? I'd wager than an incredibly small number of folks getting near retirement are in acceptable financial shape by that standard.

I could easily retire today. I work because I choose to.

I bet one could count on one hand the number of middle-class workers who have that much saved away. Even without a Regressive government chipping away at our earnings with both fists it would be next to impossible to save that much.

They must be talking about lotto winners...

My Dad worked everyday until he was 91 and had a stroke. Mentally he is all there would go back to work if he could physically. He saved and invested to where he didn’t need to work after age 70 but that was not in his genes.

I will be the same way. I am a business owner and have saved and invested well enough to take care of my needs and my Kids lives. Have no debt but will work like my Dad as long as I am healthy. I fall into the Boomer range of having saved 300K or more. More is the key word for me.

When I was 50, I actually had 10.64 times my then annual salary in hard-dollar savings. By the time I retired at age 61, I had 24.45 times my final salary.

But it is very tough to save this much, I’m probably the only one here who did it.

During the Obama recession, I got laid off twice. Wiped out my retirement to pay bills and stay afloat, so at 52, I am having to start all over.

Thank you Obama

I considered myself pretty well set going into 2007 - 2008 but unfortunately cannot say that any longer. I’ve got 15 to 20 years to correct the situation or will need to work until I die. That, or depend solely on Social Security and a very small pension assuming it survives. I suspect many are in the exact same situation.

I can’t save anything. The FED takes all of my extra income for taxes.

Work harder, millions of welfare bums, illegal aliens, and deadbeat single mothers need YOU! to pay for all of their wants and needs.

And all of these bottom feeder parasites vote straight democrat to guarantee that the government will continue to confiscate your earnings to finance their deviant lifestyles.

Only twenty more years to go for me. I’m 65 now.

The only solution of course is another far-left president who will forgive everyone's debts and let them all keep going to school until they're 80 years old.

Bumperoonie

Not gonna happen with me, but it's sentimentally nice.

I’m counting on Publisher’s Clearinghouse to come through for me to retire.

That’s a scary chart! Two Kids’ Mom and I are fortunate enough to be in the brown category, but I’m still worried that we won’t have enough for the future. It would be a lot more comforting if we were in the double-comma club.

For once in my life I’m above average.

What saved me was a (very) little discipline and the miracle of compound interest. A hundred bucks a month doesn't sound like a lot but twenty years later, it is. Just tuck it away and forget about it. As someone else said, pay yourself first and make sure it goes into a place with the least taxation.

When you get close, time gets weird. If you don't have a plan in place, you end up out of control, behind the power curve and thrashing to catch up. I had it on a calendar, and I recall repeatedly looking at the thing and saying, "It's time for that, already?" It is hard work to retire, you don't just slide into it unless you don't mind some possibly negative outcomes. Such as starvation.

Here were my goals:

1. School debt paid off. That was easy for me and will be a bitch for my nephews and niece.

2. Retirement home bought and mortgage paid off.

3. Car paid off.

4. Credit cards paid off.

5. Investments transitioned to retirement status (this is a moving target and be prepared to manage it)

6. Plans for medical benefits thoroughly investigated and in place - I can truly say that 0bama cost me a couple of years in this regard.

7. Most important: think through what you're going to be doing in retirement. Retire to something, not from something.

My friends have a bet that I'll be bored off my butt and working for a salary in five years. I don't think so. No, indeed...

LOL!

At 63, I have exactly $0.00 saved, and I own a business.